Governor of the Bank of Japan Kazuo Ueda said that the central bank will act cautiously to anchor inflation expectations at 2% during his speech at the BOJ's annual conference.

- some challenges are exceptionally difficult for the BOJ compared to other central banks worldwide;

- assessing the neutral interest rate is particularly challenging in Japan, considering the prolonged period of nearly zero short-term interest rates over the past three decades;

- deputy Governor Shinichi Uchida mentioned that although the end of deflation is near, anchoring inflation expectations is a challenge;

- former board member Takako Masai suggested that the BOJ could raise its benchmark interest rate to 0.5% by the end of the year if current economic conditions persist;

- Ueda and Uchida gave no clear indications of immediate monetary policy actions.

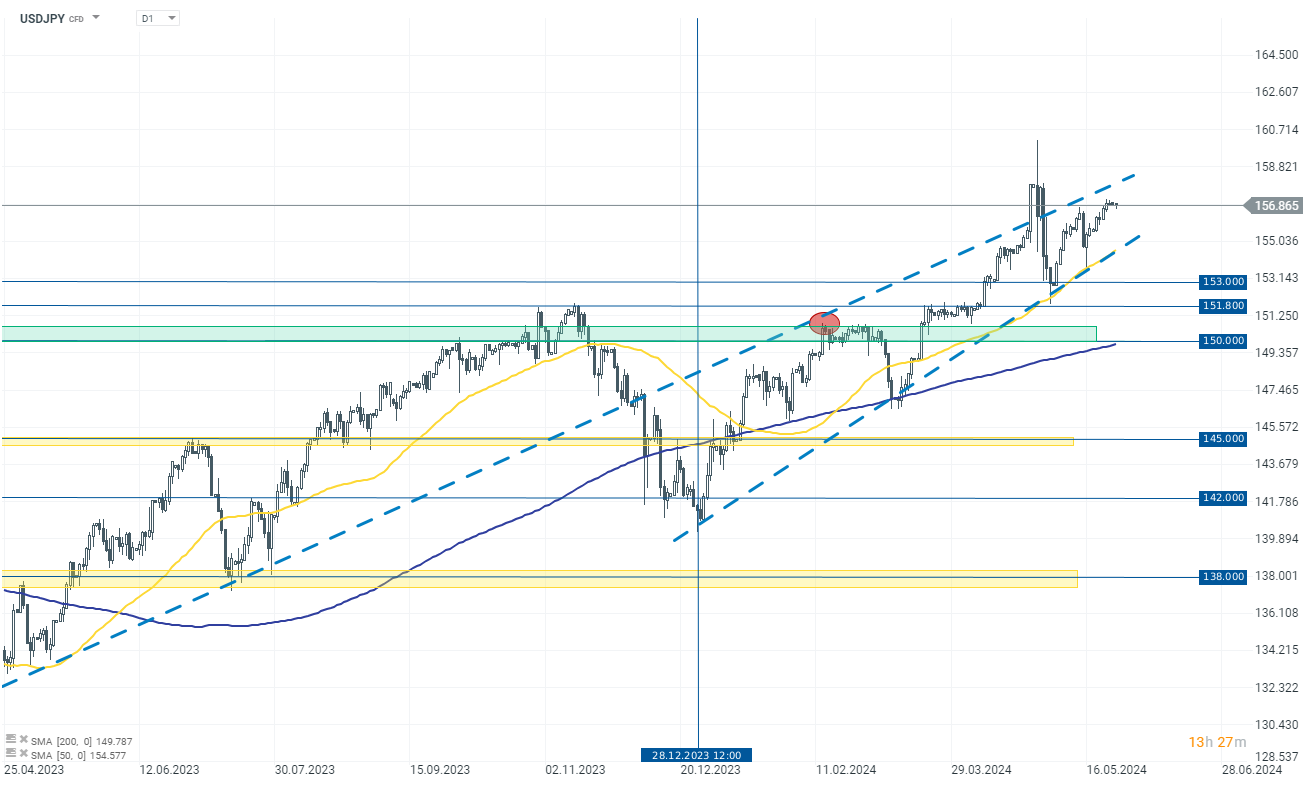

The Japanese yen is consolidating around historical highs at 157.0000 per USD. Recent statements from BOJ officials emphasize further mobilization in normalizing monetary policy. However, the bank's actions alone are insufficient to revive demand for the Japanese currency. Investors still lack clear assurances of the Bank of Japan's subsequent actions, and this uncertainty contributes to the continued weakening of the JPY. Currently, on the daily interval chart, we can observe a rising wedge formation on USDJPY, which may signal a potential reversal in an uptrend. It is characterized by converging trend lines, where the upper trend line (resistance) is rising, and the lower trend line (support) is rising at a steeper angle.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.