The Bank of Japan's monetary policy meeting held on December 18 and 19, 2023, concluded with a decision to maintain the status quo on monetary policy. This includes continuing with a negative interest rate of minus 0.1% and purchasing Japanese government bonds (JGBs) without an upper limit to keep 10-year JGB yields at around zero percent. In their discussions, members expressed the need for ongoing monetary easing, highlighting its importance in supporting Japan's moderate economic recovery and creating an environment conducive to wage increases. They acknowledged the current uncertainties surrounding Japan's economic activity and prices, noting the impact of global economic conditions, commodity prices, and domestic wage and price-setting behaviors.

Looking ahead, the members shared a consensus that Japan's economy is likely to continue its moderate recovery, supported by factors such as pent-up demand, despite facing downward pressure from a slowdown in overseas economies. They projected that the economy would grow at a pace above its potential growth rate. The members anticipated that the year-on-year rate of increase in the consumer price index (CPI) would likely remain above 2% through fiscal 2024, influenced by residual effects of cost increases, including those from past import price rises.

Despite comments from the Bank of Japan (BoJ) bankers, today the CPI data from Japan were published, which came in below expectations. The core CPI index was 1.6% year-on-year, which is a lower reading than last month's 2.1% year-on-year. The data indicate low inflationary pressure, reducing the chances of normalizing YCC.

- CPI index: current 2.2% year-on-year; previously 2.7% year-on-year;

- Core CPI index in Tokyo: current 1.6% year-on-year; forecast 1.9% year-on-year; previously 2.1% year-on-year;

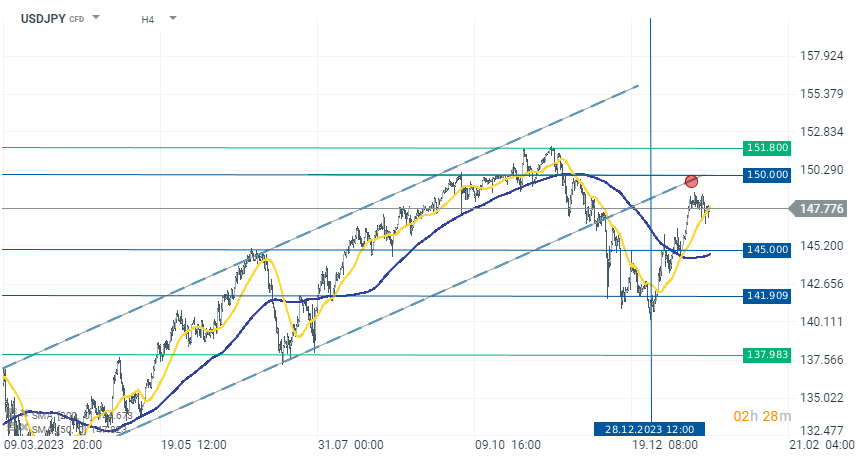

The USDJPY exchange rate remains high around 147.800 and has been moving sideways for over a week. Most likely, we will have to wait for more significant movements until the Fed meeting next week.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.