-

USDJPY pair is influenced by a weaker dollar and lower bond yields

-

A potential BoJ intervention effectively repel USDJPY from 145 level

-

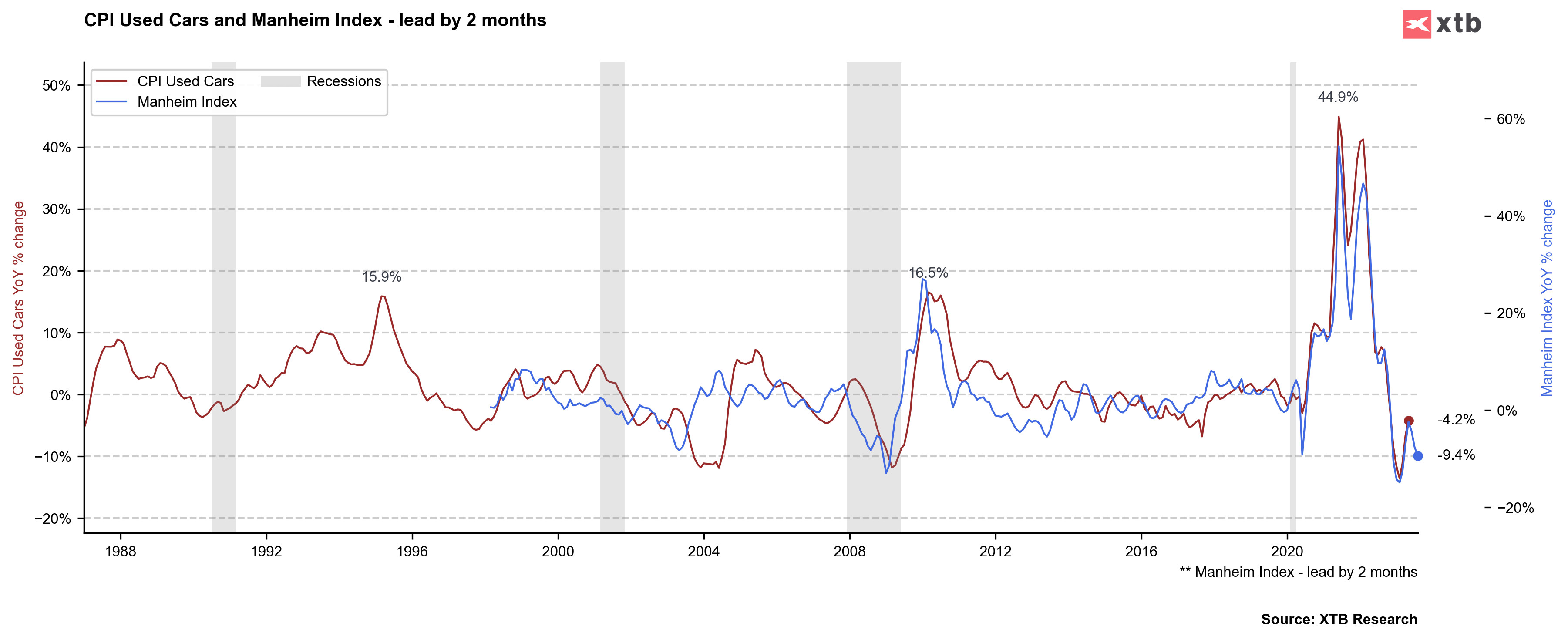

Decline in the used car price index, which correlates with US core inflation, contributes to lower expectations

USDJPY pair faced downward pressure as a result of the US dollar weakening and lower bond yields. Traders expect softer US CPI figures which could be confirmed by a decline in the used car price index, which closely reflects core inflation. The resistance at the 145.00 level in USDJPY persists, possibly due to potential intervention by the Bank of Japan. The dollar's recent weakness has also contributed to its decline against the euro and sterling.

USDJPY pair faced downward pressure as a result of the US dollar weakening and lower bond yields. Traders expect softer US CPI figures which could be confirmed by a decline in the used car price index, which closely reflects core inflation. The resistance at the 145.00 level in USDJPY persists, possibly due to potential intervention by the Bank of Japan. The dollar's recent weakness has also contributed to its decline against the euro and sterling.

USDJPY - It is anticipated that the pair will continue to face downward pressure, with focus shifting towards the 140.00 level. Currently, the pair is trading within the range of 140.00 to 145.00 and market participants are awaiting the US CPI data for further confirmation.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.