Japanese Yen loses another 0.15% against the USD today, reaching new highs at 161.700. Global market confidence in the Japanese currency is declining, as it has already lost 13.20% this year. At the same time, the yen is losing global recognition as a safe-haven asset during tough times. The nearly 40% devaluation against the dollar has been ongoing since early 2022, when the rate was just 115.000.

The Bank of Japan has been somewhat helpless recently, as interventions amounting to over 60 billion dollars in April proved to be short-term. Such a result certainly does not encourage policymakers to undertake similar interventions in the near future. As long as the interest rate differential remains substantial, the pressure on the yen will most likely continue. Moreover, Japanese officials have stated that they do not defend the currency at a specific level and usually intervene after sharp, rather than gradual, declines. According to Wells Fargo analysts, the Bank of Japan will hold off on potential intervention at least until the USDJPY pair reaches 165.

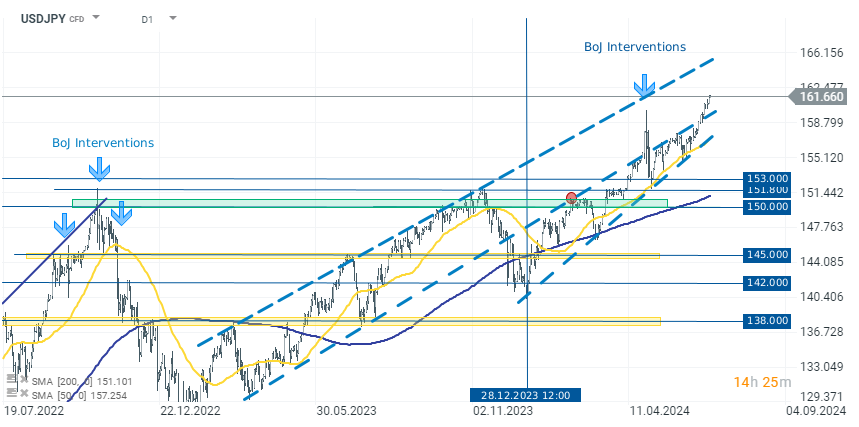

USDJPY (D1)

On the daily USDJPY chart, we can see an acceleration in the upward momentum recently. Before breaking above the multi-year upward trend line, we observed a rising wedge formation, which usually suggests a trend reversal. However, a relatively strong USD and weak JPY allowed the bulls to break higher and return to the upward trend channel from 2023.

Source: xStation 5

Source: xStation 5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.