New variant of coronavirus - Omicron - sent shockwaves across the global financial markets on Friday. While risk assets recovered somewhat on Monday, another wave of selling arrived today. Potential disruptions in the global economy triggered by Omicron pose a significant risk to the growth outlook.

Chairman of the Federal Reserve, Jerome Powell, will hold the first of two congressional testimonies this week (today and tomorrow at 3:00 pm GMT). While the event is related to Powell being nominated for the second term at the helm of Fed, questions about the current situation are likely to be asked. According to a pre-released text of the testimony, Powell will say that previous waves of the pandemic had a great impact on the labour market and the economy with people being afraid to go to shops, restaurants or offices. Such cautious comments hint that the Federal Reserve may wait to see how the Omicron situation develops and, in turn, delay further policy tightening. On the other hand, while Powell once again said he believes inflation pick-up to be transitory, he also said that higher price growth will linger well into 2022.

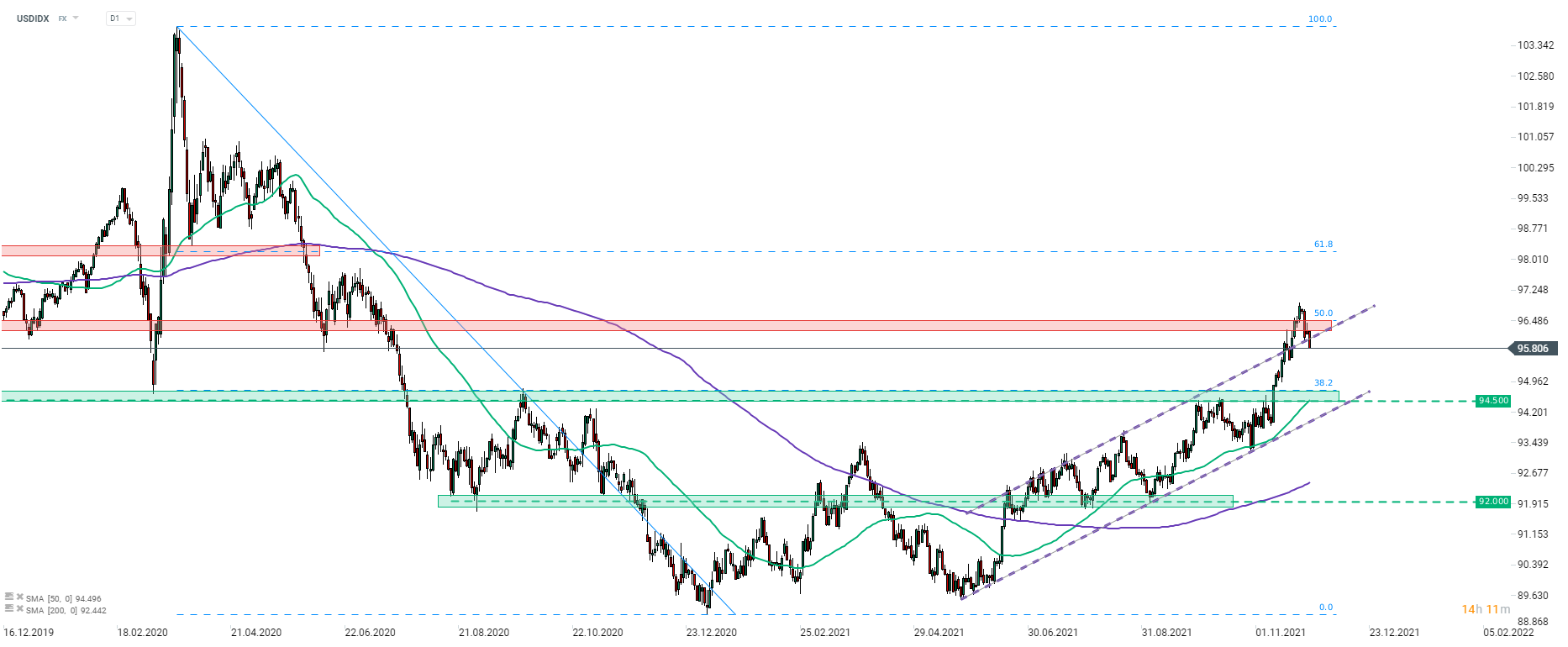

It looks like markets have been pricing more dovish Fed since Friday. A look at the US dollar index (USDIDX) shows us that the index halted advance at the end of the previous week and started to move lower. USDIDX quickly pulled back below the 50% retracement of 2020 drop and moved back into the range of the earlier-broken upward channel. Key near-term support to watch can be found ranging between 94.50 handle and 38.2% retracement.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.