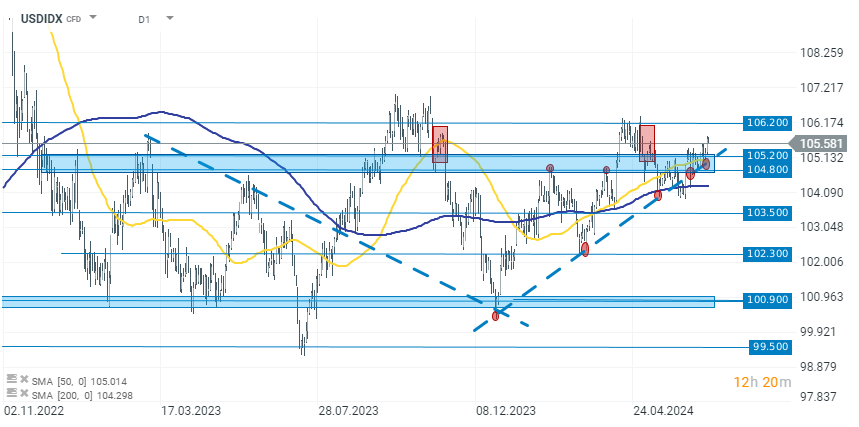

The dollar has been exceptionally strong in recent days, breaking above a significant resistance zone. Although the dollar index USDIDX is down today by 0.12% to 105.570 points, this is merely a pullback after yesterday's dynamic increases.

From a fundamental perspective, not much has changed so far this week. However, PMI data from the end of last week, which acted as another growth catalyst, may continue to support the bulls. Mixed data are coming from the USA, but overall reports still indicate a strong economy. Federal Reserve bankers remain more hawkish and are not gearing up for quick cuts. Recent comments suggest that maintaining an optimistic inflation trend is necessary before considering interest rate cuts. In this context, next week we will learn about labor market data, which will show the condition of the economy in June.

USDIDX (D1)

Looking at the dollar index USDIDX chart, we see that the quotations have broken above the key resistance level around 104.800-105.200. For two years, the dollar has been moving in a sideways channel ranging from 100.000 to 106.200. Currently, we are practically 1.00% below testing the upper limit. However, the index is already in the area that has marked local peaks in recent months. The current upward trend line (dotted blue line) is a significant support. Therefore, breaking it downwards will be crucial for reversing the trend. From above, the next resistance level for the dollar remains the peaks around 106.000 points.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.