The dollar extends its downward trend, reaching its lowest level since the beginning of the year. The dollar's decline is being supported by growing expectations of a Fed pivot at the September FOMC meeting.

Although there are still several important macroeconomic reports to be released before the meeting, such as labor market data, FOMC bankers are already suggesting a 25 basis point rate cut. Yesterday, we heard opinions from Kashkari, Daly, and Goolsbee. The first two bankers acknowledged that cuts in September would be justified, and progress in combating inflation is noticeable. Meanwhile, Goolsbee, who usually leans dovish, remained relatively neutral, noting that the labor market could be a key argument for rate cuts. Today, we will learn opinions from two more bankers, Bostic and Barr.

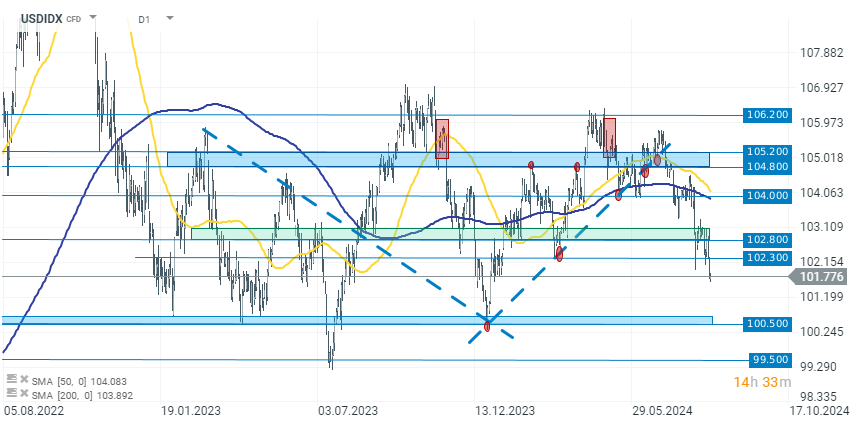

Nevertheless, the start of a rate-cutting cycle in the U.S. is approaching inevitably, which should support the continued downward trend. At the end of 2023, a local low near 100.5000 was established based on rate-cut speculation. Currently, the start of an actual easing cycle in September is highly likely, and almost certain within the next two meetings. Therefore, the chances of breaking out of the nearly two-year consolidation channel on the USDIDX are now higher.

USDIDX (D1 interval)

The dollar index lost nearly 0.50% yesterday. The next likely target for the downward move appears to be levels around 100.5000.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.