The US dollar index (USDIDX) resumed a downward move after a brief pause yesterday. The index erased earlier gains and swung to a daily loss, taking out yesterday's low in the process. As a result, USDIDX is trading at the lowest level since mid-August 2022. Recent US dollar weakness can be reasoned with somewhat weaker data from the United States, that has reignited hopes for a Fed pivot. Cooler-than-expected CPI reading for October saw market odds for another 75 basis point rate hike to diminish. Also Fed's Waller said that 50 basis point rate hike will be discussed for December meeting although he also stressed that a single dovish macro report, like recent CPI reading, is not enough to alter Fed's view that inflation is not yet under control. While certainly not as important and closely watched as CPI data, today's US PPI report for October may trigger some additional USD volatility.

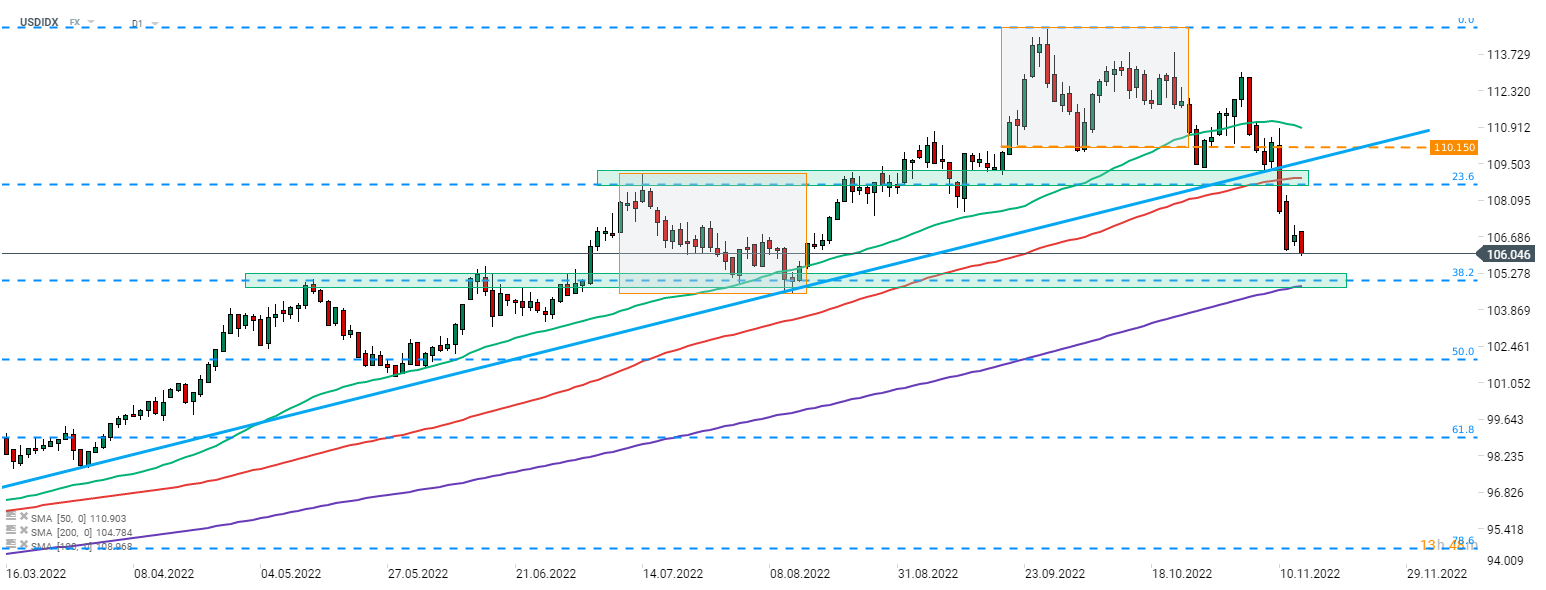

Taking a look at USD index chart (USDIDX) at D1 interval, we can see that the index continues to move lower following an earlier break below the lower limit of a market geometry and the upward trendline. The next major support zone to watch can be found in the 105.00 area, and is marked with 38.2% retracement of the upward move launched at the beginning of 2021 as well as previous price reactions and 200-session moving average.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.