The Dollar Index (USDIDX) has formed a double top formation, which may indicate a continuation of the downward movement in the coming weeks. Tomorrow's CPI inflation data will be crucial for this trend. If the report is better than expected, we might see a return to dollar gains. However, if the publication matches expectations or is even lower, a continuation of declines is possible. It is also worth noting that a resurgence of CPI inflation to 3.4% year-on-year is expected, compared to 3.2% year-on-year in February.

The dollar has been strengthening in recent weeks, but relatively weakly, considering the strong labor market data and the shifting expectations of the first interest rate cuts possibly to September. At the same time, U.S. bond yields have risen significantly more, to levels last seen in November 2023. In such a case, the dollar still lacks 2-3% to reach these levels.

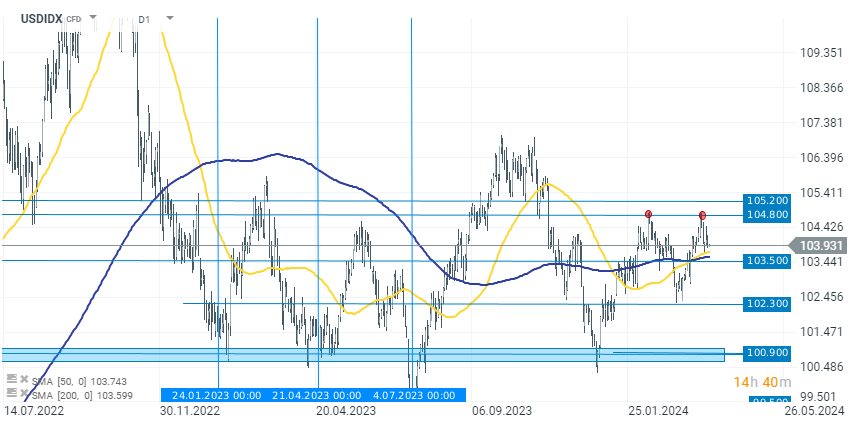

USDIDX, D1 Interval

Looking at the chart from a technical perspective, it's important to note the forming double top at a medium interval. The Dollar Index attempted to break above the 104,800 zone twice. Currently, the quotes have fallen below 104,000 points. If this movement continues, we can expect the next resistance in the range of 102,300 points. Otherwise, the 104,800 levels still remain the nearest resistance zone.

Source: xStation 5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.