Today, the dollar is exceptionally strong in the first part of the day. The US Dollar Index (USDIDX) is gaining 0.16%, and earlier in the day, the increases even exceeded 0.20%. However, the current rebound is a reaction to the declines that occurred in the first week of May, after a short period of consolidation at the peaks at the end of April. As seen in the chart below, the recent movement in the dollar has pushed the price of USDIDX almost to the local peak levels of October 2023.

Source: xStation 5

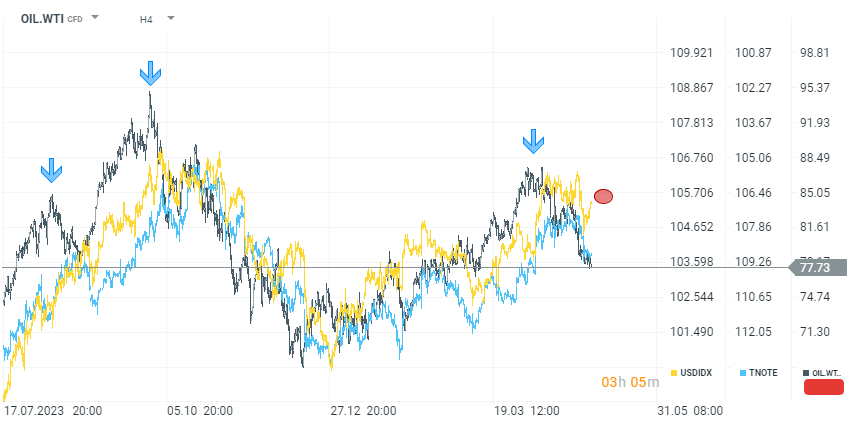

The dollar's behavior in the coming weeks could be a direct indicator of the direction for stock indices and other more risky assets. Therefore, it is crucial to determine potential directions. The recent weeks have been a period of revising investors' expectations regarding the first interest rate cuts this year. The current, quite hawkish, expectations have increased the value of less risky assets such as the dollar. For this reason, theoretically, the potential for further increases has been exhausted. Following the Fed's decision and weaker labor market reports, we observed calmer moods and a capital outflow from the dollar. These declines were also supported by falling oil prices (OIL.WTI) and rising prices of 10-year bonds (TNOTE), which are directly correlated with the dollar. In the chart below, we see that movements on TNOTE and oil indicate further declines in USDIDX. Therefore, assuming a continuation of the trend in this direction, we can expect sustained pressure on the dollar.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.