- The PBoC set a stronger-than-expected daily reference rate for the yuan

- Reverse repo operation injects liquidity into the offshore yuan

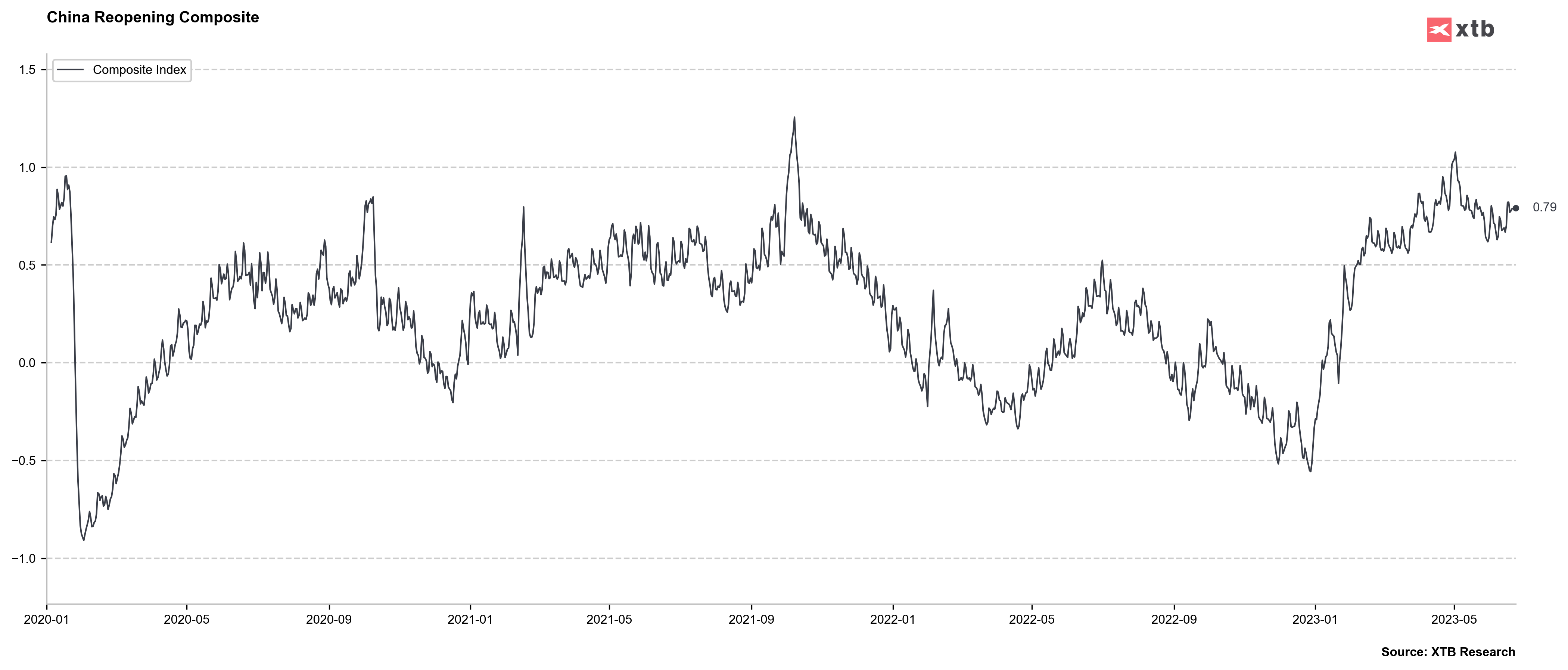

- Economic challenges persist in China, with weak growth and rising youth unemployment, but robust measures are being taken to support the yuan

In an attempt to counter investor pessimism surrounding China's economic challenges, including weak growth and surging youth unemployment, the People's Bank of China (PBOC) has taken decisive action. The PBoC set the daily reference rate for the yuan stronger than market expectations, aiming to bolster the currency and exhibit its control over monetary policy.

-

The PBoC set the midpoint rate USDCNY at 7.2098 per US dollar prior to market open, weaker than the previous fix of 7.2056, but nearly 100 pips stronger than consensus estimates and compared with the last close of 7.2425.

This move was interpreted as a sign of the PBOC's reluctance to let the yuan depreciate rapidly, despite the bearish pressure on the currency due to the weakening economic outlook.

Complementing the PBOC's intervention, the bank carried out a reverse repo operation last night injecting liquidity worth 37 billion yuan. This action, combined with previous interventions, has added a total of 219 billion yuan (equivalent to USD 30.4 billion) during the last seven days. The reverse repo operation was conducted at an interest rate of 1.9%.

Complementing the PBOC's intervention, the bank carried out a reverse repo operation last night injecting liquidity worth 37 billion yuan. This action, combined with previous interventions, has added a total of 219 billion yuan (equivalent to USD 30.4 billion) during the last seven days. The reverse repo operation was conducted at an interest rate of 1.9%.

The USDCNH price is currently at 7.2097, experiencing a decline of 0.45% for the day. The price has been following a strong uptrend channel since the beginning of the year 2023. It's worth noting that the multiyear high for this currency pair was reached last year at 7.3602. In terms of future price movements, the next resistance level can be identified as the level above the multiyear high, which is 7.3602. On the other hand, the support level is situated at 7.1918, which coincides with the previous peaks observed in 2019 and 2020.

The USDCNH price is currently at 7.2097, experiencing a decline of 0.45% for the day. The price has been following a strong uptrend channel since the beginning of the year 2023. It's worth noting that the multiyear high for this currency pair was reached last year at 7.3602. In terms of future price movements, the next resistance level can be identified as the level above the multiyear high, which is 7.3602. On the other hand, the support level is situated at 7.1918, which coincides with the previous peaks observed in 2019 and 2020.

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.