Release of FOMC minutes is a top macro event of the day (7:00 pm BST). Fed Chair Powell hinted that the document will include details on discussions on balance sheet reduction. So far, market expectations are for a quantitative tightening announcement during a meeting in May with an immediate launch, on top of a more and more likely 50 basis point rate hike. Minutes are likely to confirm expectations on timing of QT start. However, what remains uncertain is pace of balance sheet reduction. Some Fed members, like for example Vice Chair Brainard, said that balance sheet runoff will be rapid. Pace of quantitative tightening will be a key thing to watch in today's minutes.

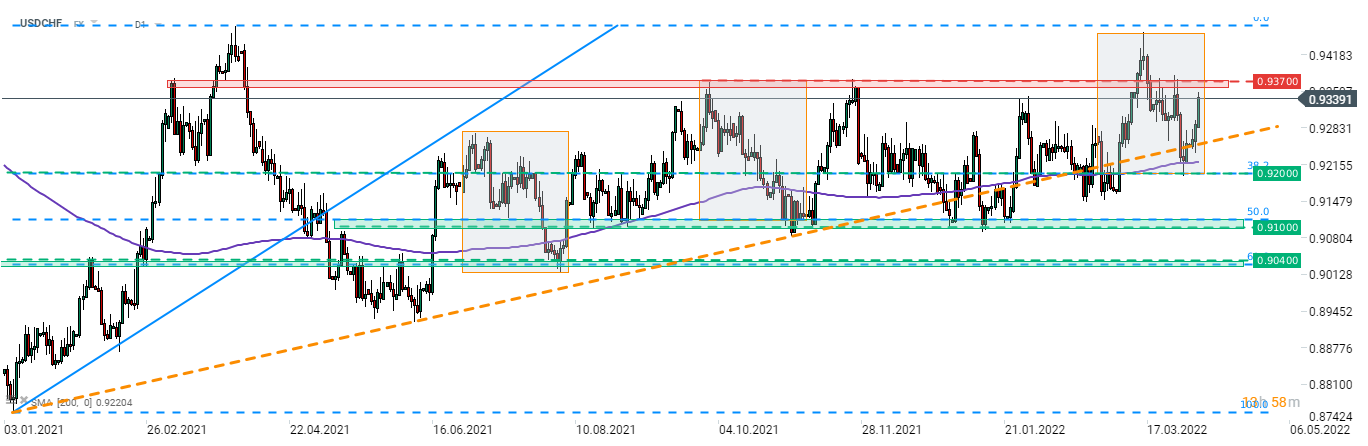

Release is expected to trigger some additional volatility on the USD market, and potentially on the stock market as well. Taking a look at the USDCHF chart, we can see that the pair managed to defend support level at 0.9200, marked with 38.2% retracement of early-2021 rally. This area was also marked with lower limit of market geometry therefore a bounce seems to confirm mid-term upward trend. The pair is approaching a resistance zone at 0.9370 and should bulls manage to break above it, way towards 2021 and 2022 highs will be left open.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.