The US dollar index is one of the best performing G10 currencies today. USD gains on safe haven flows amid deterioration in overall market moods. A looming economic recession is putting pressure on price of risk assets, causing investors to seek safety. Meanwhile, US dollar is also being support by outlook for a more hawkish monetary policy in the months to come.

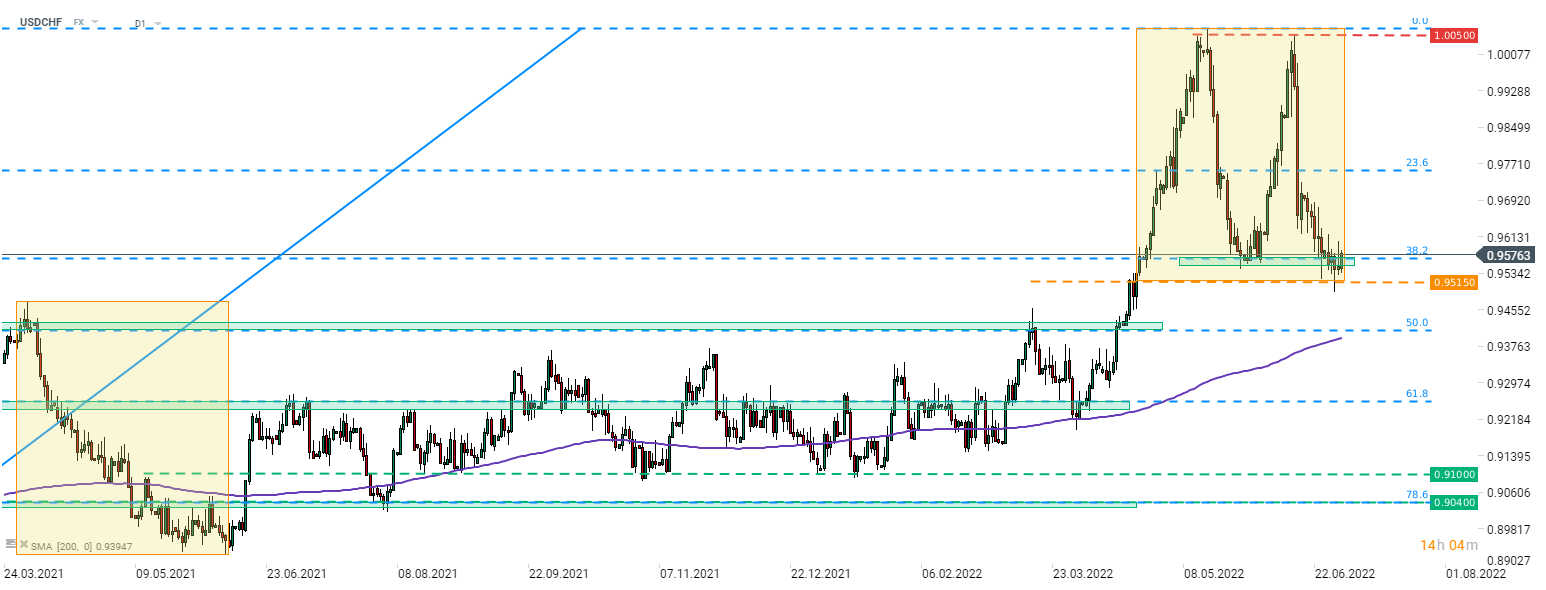

Taking a look at USDCHF chart at D1 interval, we can see that the pair painted a double top in the 1.0050 area. A quick drop occurred later on and USDCHF began assault on support zone at 38.2% retracement of the upward move launched at the beginning of 2021, that also marks the neckline of the double top pattern (0.9560 area). The lower limit of the Overbalance structure can be found slightly below this zone. After an unsuccessful attempt at breaking below the Overbalance structure, the pair started to recover and is making its way back above 38.2% retracement today, suggesting that the uptrend is still in play. Pair may experience a jump in short-term volatility around ISM manufacturing release today at 3:00 pm BST.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.