USDCAD could be one of the FX pairs that may experience some elevated volatility today. This is because there is Canadian CPI report for May scheduled for release at 1:30 pm BST, followed by US Conference Board consumer confidence index for June.

Canadian report is expected to show a small deceleration in headline CPI inflation from 2.7% in April to 2.6% YoY in May, as well as deceleration in core CPI inflation from 1.6% to 1.4% YoY. Conference Board index is expected to show a deterioration from 102.0 in May to 100.2 in June. While US data is likely to have an only short-term impact on USD, Canadian inflation report will be watched more closely as release confirming expected slowdown or showing a bigger-than-expected slowdown in price growth may encourage Bank of Canada to proceed with more rate cuts, following a 25 basis point reduction at last meeting.

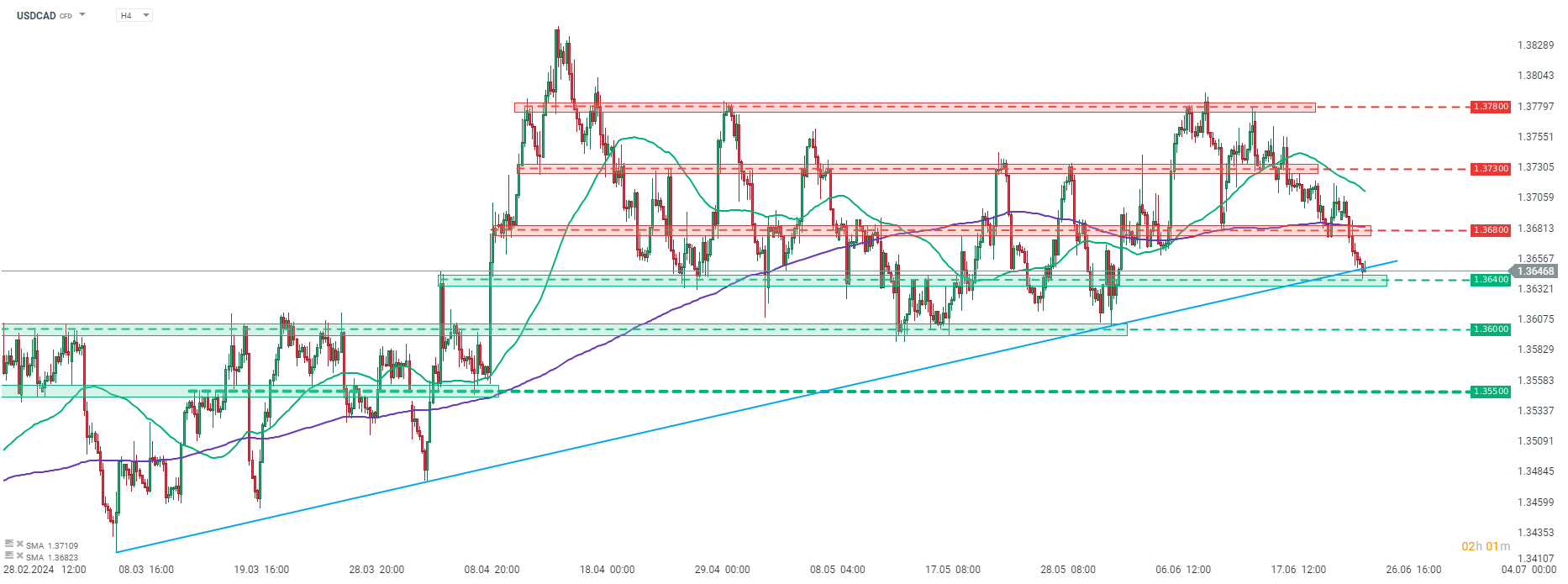

Taking a look at USDCAD chart at H4 interval, we can see that the pair has been trading sideways since mid-April. Pair has recently pulled back from the 1.3780 area and is now testing 1.3640 support zone, marked with previous price reaction and an upward trend line. A dovish surprise in Canadian data may help the pair recover some ground. In such a scenario, the first near-term resistance level can be found in the 1.3680 area, marked with 200-period moving average (purple line) and previous price reactions.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.