Economic calendar today is light but traders will be offered some noteworthy data from Canada and the United States in the afternoon. Canadian retail sales data at 1:30 pm GMT is expected to show monthly drops in headline and ex-autos gauges while US existing home sales data for December is expected to show a drop compared to November. While neither of those is considered a top-tier piece of macro data, those reports tend to trigger short-term volatility on USD and CAD. This is especially true for CAD as Bank of Canada is set to announce its next monetary policy decision next week and retail sales print today is the final piece of macro data ahead.

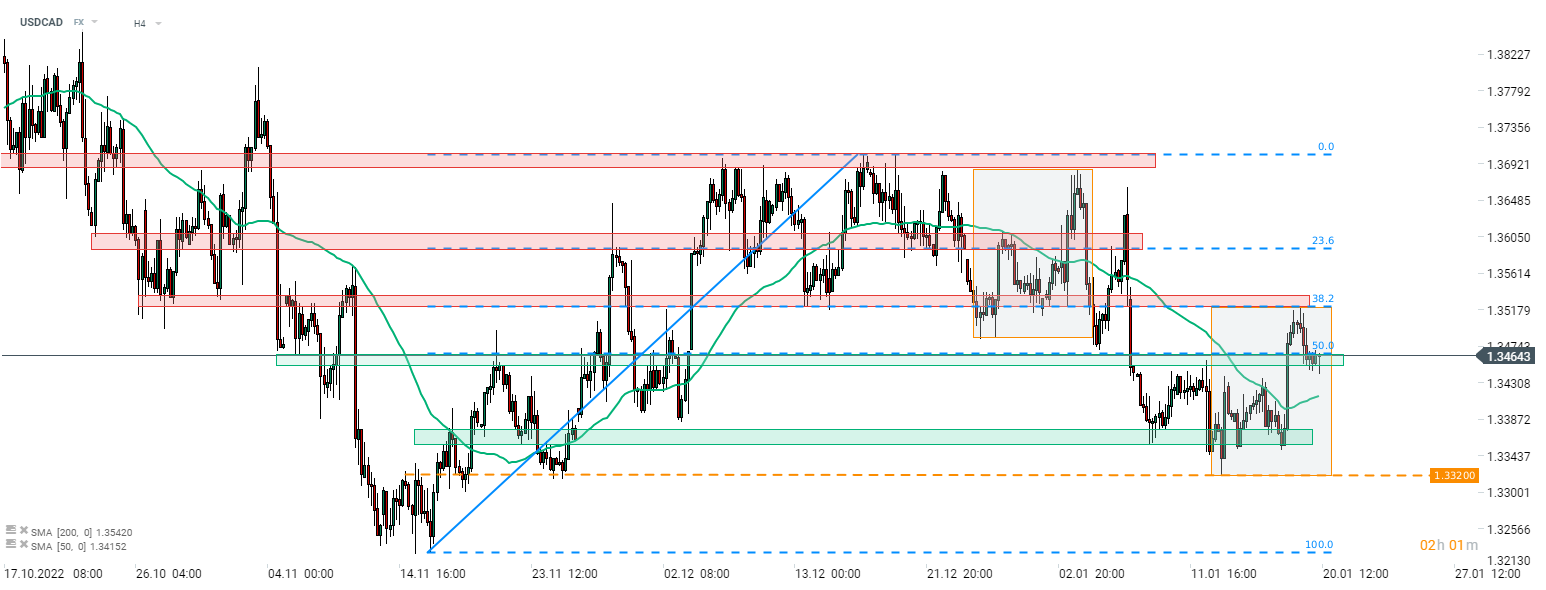

Taking a look at USDCAD chart at H4 interval, we can see that the pair has recently halted upward correction at the resistance zone ranging above 38.2% retracement (1.3525) and started to pull back. Note that the aforementioned zone also marks the upper limit of the Overbalance structure therefore failing to break above it and pulling back away from it signals that downtrend remains in play. The pair is currently testing a support zone marked with 50% retracement in the 1.3450 area. The first attempts to break below turned out to be a failure. Should bulls manage to defend the 1.3450 area, another upward correction may be launched. In such a scenario, the resistance zone at 38.2% retracement that halted recent advance will once again become a target for buyers.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.