USDCAD is one of the pairs to watch in the early afternoon as the first Friday of a new month has come and therefore it is time for release of jobs data from the United States and Canada. Of course, report from the United States will be watched more closely than Canadian one but the fact that both will be released at the same time (1:30 pm BST) means that USDCAD is likely to become very volatile around that hour.

The US report is expected to show a 200k increase in non-farm payrolls, slightly lower than the 209k reported in June. Unemployment rate is seen staying at 3.6% while annual wage growth is seen slowing from 4.4 to 4.2% YoY. Fed Chair Powell stressed that the September decision will be data-dependent and there are 4 key US macro reports ahead of the September 20, 2023 meeting - 2 jobs reports and 2 CPI reports. NFP report for July is the first one of the four and will be watched closely. A higher-than-expected jobs gain and a smaller drop in wage growth would likely boost hawkish bets in the markets and may trigger gains on the USD market as well as declines on equities.

The Canadian report is not expected to have as much gravity as the Bank of Canada is largely seen as having already finished its rate hike cycle. Nevertheless, release is likely to trigger some short-term CAD-volatility.

US, NFP report for July

-

Non-farm payrolls. Expected: 200k. Previous: 209k

-

Private payrolls. Expected: 180k. Previous: 149k (ADP: +324k)

-

Unemployment rate. Expected: 3.6%. Previous: 3.6%

-

Wage growth: 4.2% YoY. Previous: 4.4% YoY

Canada, jobs report for July

-

Employment change. Expected: +22.0k. Previous: +59.9k

-

Unemployment rate. Expected: 5.5%. Previous: 5.4%

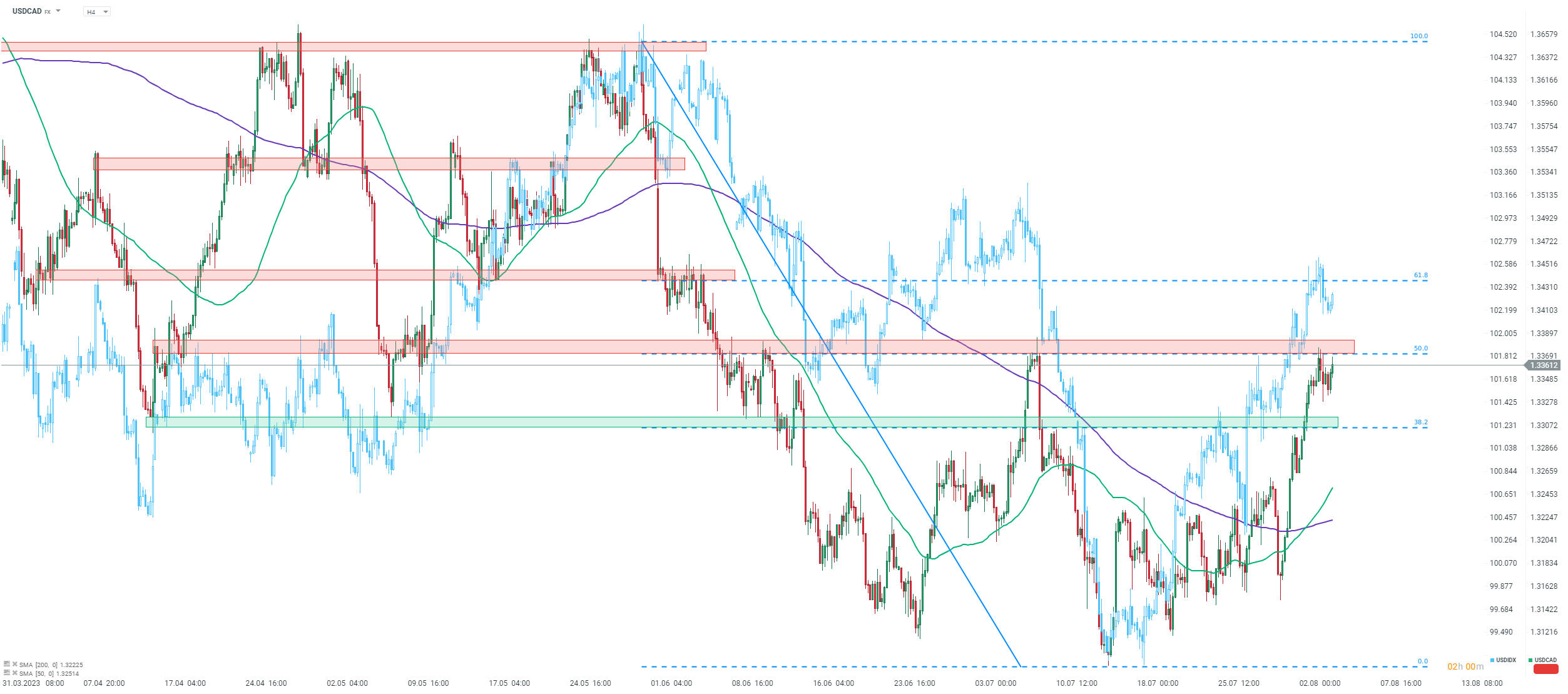

Taking a look at USDCAD chart at D1 interval, we can see that the pair has experienced strong gains recently, driven by strengthening of US dollar (USDIDX - light blue overlay). However, advance was halted after the pair reached resistance zone ranging above 50% retracement of the downward move launched at the turn of May and June 2023 (1.3370 area). This is a price zone that had halted advance in early-July as well. A strong US report combined with weaker Canadian data could trigger a break above the aforementioned 1.3370 area. In such a scenario, the next resistance to watch can be found ranging above 61.8% retracement (1.3440). On the other hand, should we see CAD gain against USD - drop in USDCAD - the support level to watch can be found at 38.2% retracement (1.3300 area).

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.