USDCAD currency pair is expected to enjoy elevated volatility today around 3:00 pm BST. ISM manufacturing index for May will be released and is expected to show a slight deterioration, from 55.4 to 54.5. However, this release is likely to be overshadowed by another event that is scheduled for the same hour - Bank of Canada rate decision. Canadian central bank is expected to deliver a 50 basis point rate hike. This would be the third rate hike in a row and the second straight 50 bp rate hike. If those expectations are met, main interest rate in Canada will return to pre-pandemic level of 1.50%.

A 75 basis point rate hike looks unlikely as recent comments from BoC members weren't supportive for the idea and deteriorating macroeconomic environment may make them even more prudent. The Bank is likely to signal that rates will need to rise further to help control inflation. The main question is whether BoC plans to continue with a 50 basis point rate hike or will switch to 25 bp moves.

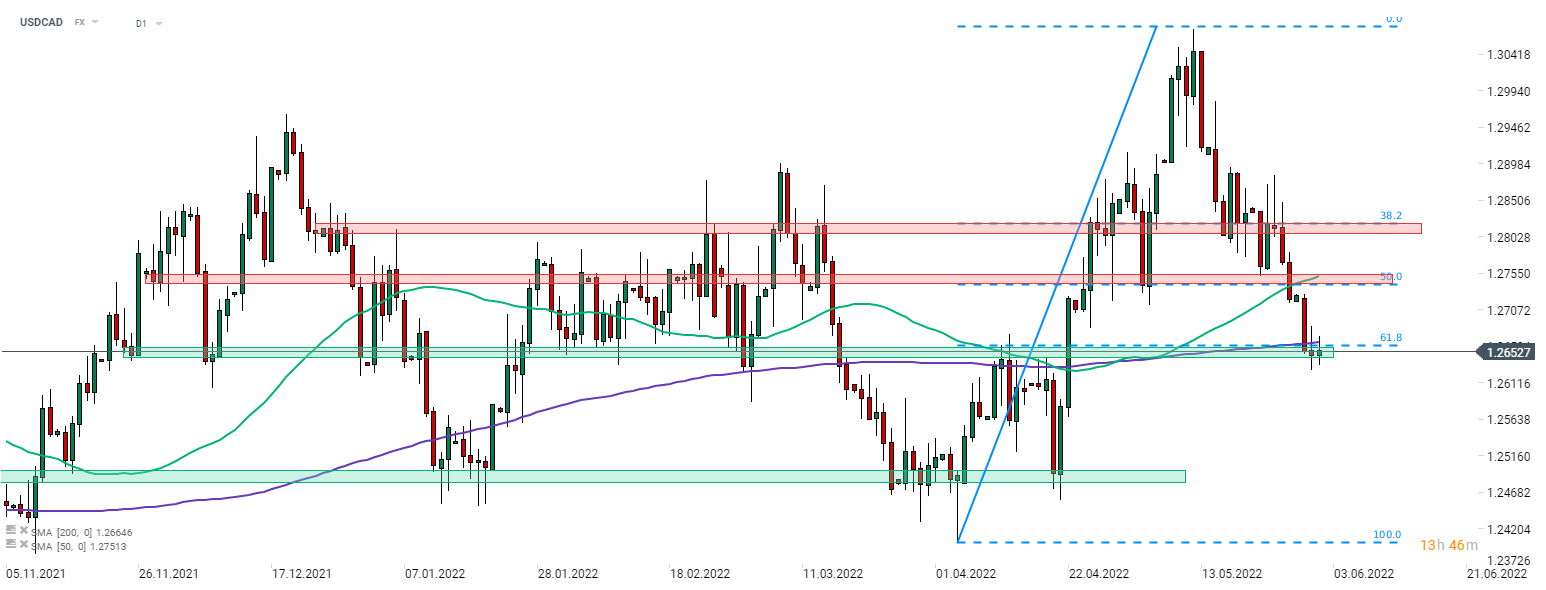

Taking a look at USDCAD chart at D1 interval, we can see that the pair has pulled back considerably over the past 3 weeks. USDCAD is currently testing a support area in the 1.2650 area that is marked with 200-session moving average and 61.8% retracement of the upward impulse launched in early-April. This is an important technical spot and today's BoC decision is likely to be a make-or-break for the pair. Statement hinting that rate hikes will continue at current pace and magnitude could greatly support CAD and push the pair below the zone.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.