Stock markets in Europe and the United States experienced a steep sell-off yesterday. German DAX (DE30) dropped 2.6% while US Dow Jones (US30) declined 2.1%. Market seems to be concerned over two things. Firstly, rising case count of Delta coronavirus variants may lead to new lockdowns, and therefore slowdown in growth. Apart from that, inflation remains a concern as well. Combination of those two things could decrease the effectiveness of monetary policy and future QE programmes.

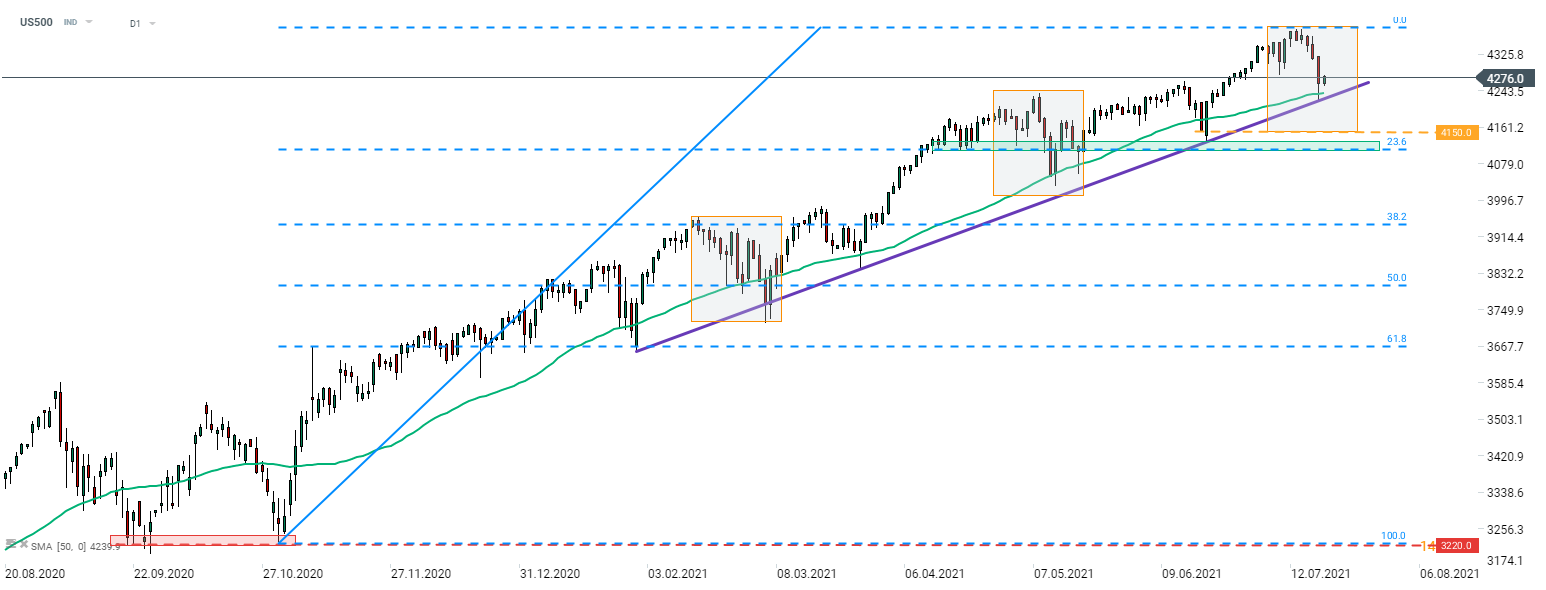

However, it looks like markets may be set for recovery today. S&P 500 futures (US500) trade 20 points above yesterday's cash close while major indices from Western Europe gain over 1%. Taking a look at US500 from a technical point of view, we can see that bulls managed to halt declines on the 50-session moving average (green line) and upward trendline. While recent declines may have seemed big, the drop was smaller than previous corrections during the current upward impulse.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.