US indices took a hit yesterday as the market started to acknowledge that potentially quick policy tightening is coming. Comments from Fed members are increasingly hawkish, exerting strong pressure on stocks, especially the tech sector. However, Wall Street earnings season has begun and it may provide some relief for stocks. Big banks from the United States and other financial institutions are usually among the first to report and this time is no different. JPMorgan (JPM.US), Wells Fargo (WFC.US), Citigroup (C.US) and BlackRock (BLK.US) will report results today ahead of the Wall Street open and those reports may set moods for the remainder of the day. Release of the US retail sales report at 1:30 pm GMT may also impact sentiment on Wall Street today.

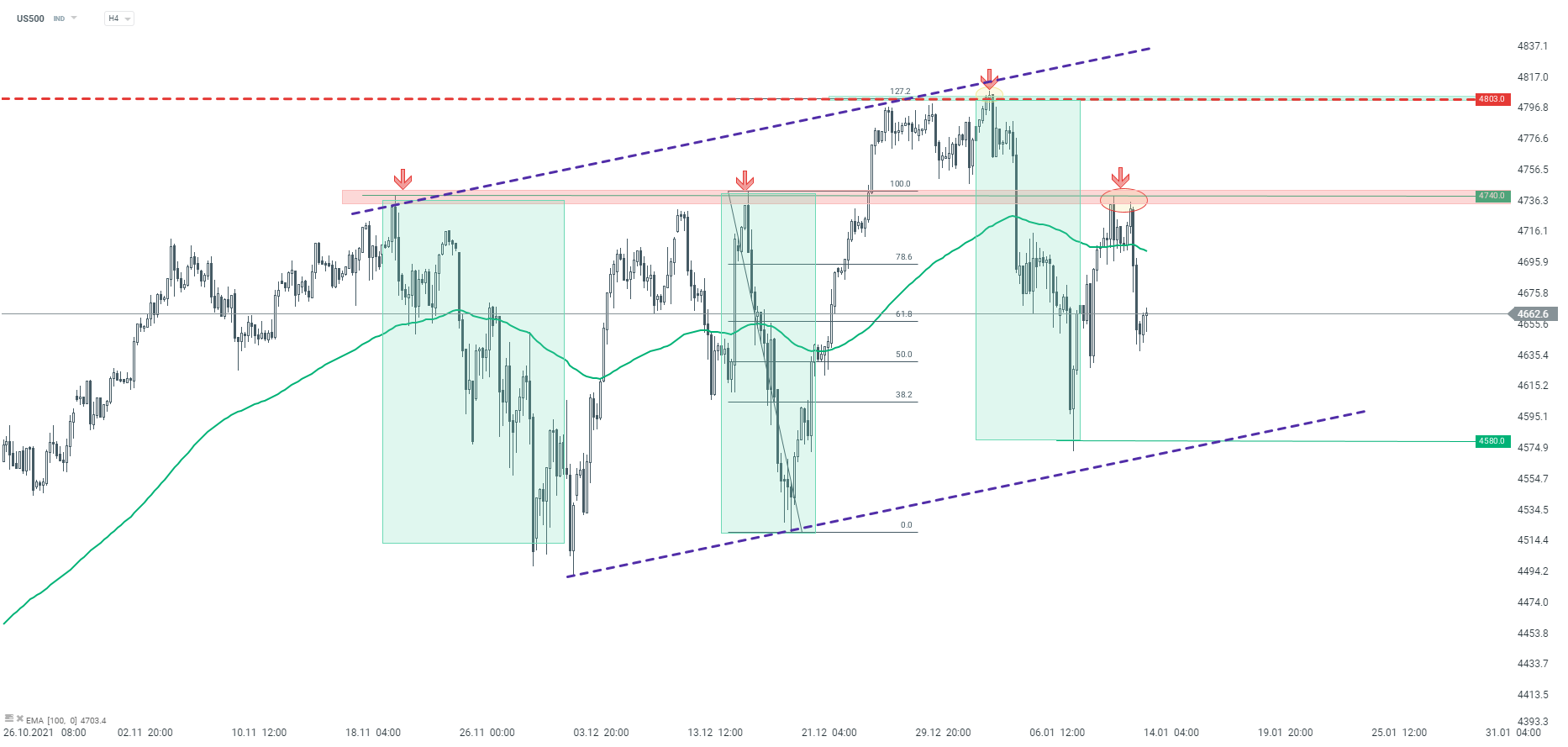

Taking a look at the S&P 500 futures chart (US500), we can see that the index failed to break above the 4,740 pts resistance zone and painted a double top in the area (orange circle). Subsequent pullback was halted in the 4,640 pts area and an attempt to launch a recovery move can be spotted at press time. Depending on how the day progresses there are 2 levels to watch - the aforementioned resistance at 4,740 pts and a support at 4,580 pts (lower limit of Overbalance structure).

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.