- SP500 at new highs this year, CFD contracts above 4500 points.

- Gains on Wall Street driven by lower macro readings.

- Will earnings season revise market expectations?

On yesterday's session on Wall Street, there was a euphoric mood after the publication of CPI data, which, in short, turned out to be significantly lower than previous readings and analyst expectations. However, realistically looking at the readings, such a low figures was possible due to a high base from last year. Maintaining this pace of decline seems unlikely, although the direction, which is further declines, is not ruled out.

Wall Street is now entering the Q2 2023 earnings season, which will likely dictate the sentiment among investors for the next few weeks. The earnings season will kick off on Friday with the largest banks, including JPMorgan Chase & Co., Citigroup Inc., and Wells Fargo & Co. Overall, analysts' expectations are quite high, and the banking sector, influenced by high interest rates, is expected to report revenues higher by as much as 11% YoY. In this context, it can be both fuel for further growth and a catalyst for a correction in case of disappointment.

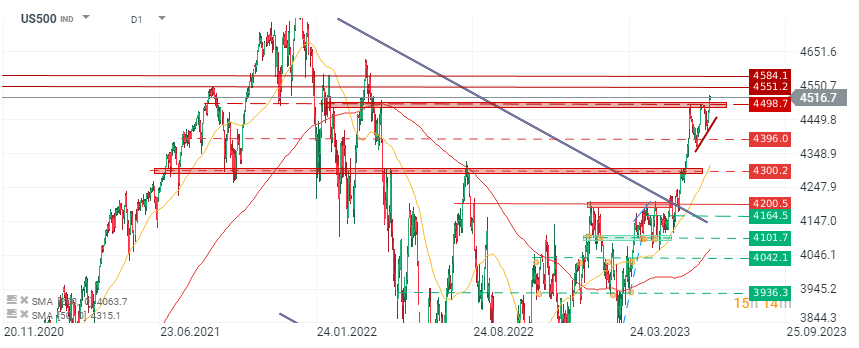

Fuelling by such a low CPI figures, investors pushed the SP500 index to new highs for this year, around 4472 points, while futures contracts on the XTB platform (US500) broke above 4500 points and the index is currently trading around 4520 points. Looking at the chart from a technical perspective, we can observe the next resistance zone around 4550-4580 points. The support zone is now at the 4500 level after yesterday's breakout, and further at 4400 points.

Fuelling by such a low CPI figures, investors pushed the SP500 index to new highs for this year, around 4472 points, while futures contracts on the XTB platform (US500) broke above 4500 points and the index is currently trading around 4520 points. Looking at the chart from a technical perspective, we can observe the next resistance zone around 4550-4580 points. The support zone is now at the 4500 level after yesterday's breakout, and further at 4400 points.

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.