Before the opening on Wall Street, the situation on the forex market is a bit calmer than yesterday. The dollar halted yesterday's declines and is even gaining slightly today. The market sentiment has cooled down a bit after yesterday's hawkish comments from FOMC bankers. The bankers want to slightly change the tone of the last Fed conference. Today, we are waiting for the second round of appearances. In this again, we will have the opportunity to listen to Fed Chairman Jerome Powell, who this time at the political panel at the annual research conference in Washington may provide a bit more insides than yesterday.

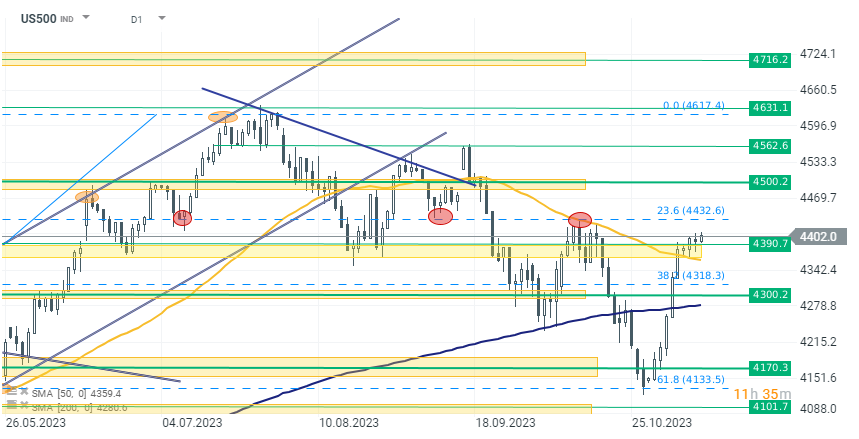

As a result, on the US500 index, we observe consolidation from 4 trading sessions. The index is quoted in the key resistance zone in the range of 4370-4400 points after recent dynamic increases. Currently, bulls are trying to break out of this zone, rising slightly above this level. If the good sentiment continues and today's bankers' appearances do not spoil it, we can observe the continuation of the uptrend towards 4430 points. This is not a distant level, but it is where the 23.6% Fibonacci retracement of the last uptrend runs. It also coincides with the local peak of the last downtrend and if it breaks above this level, we can talk about the index entering a new trend.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.