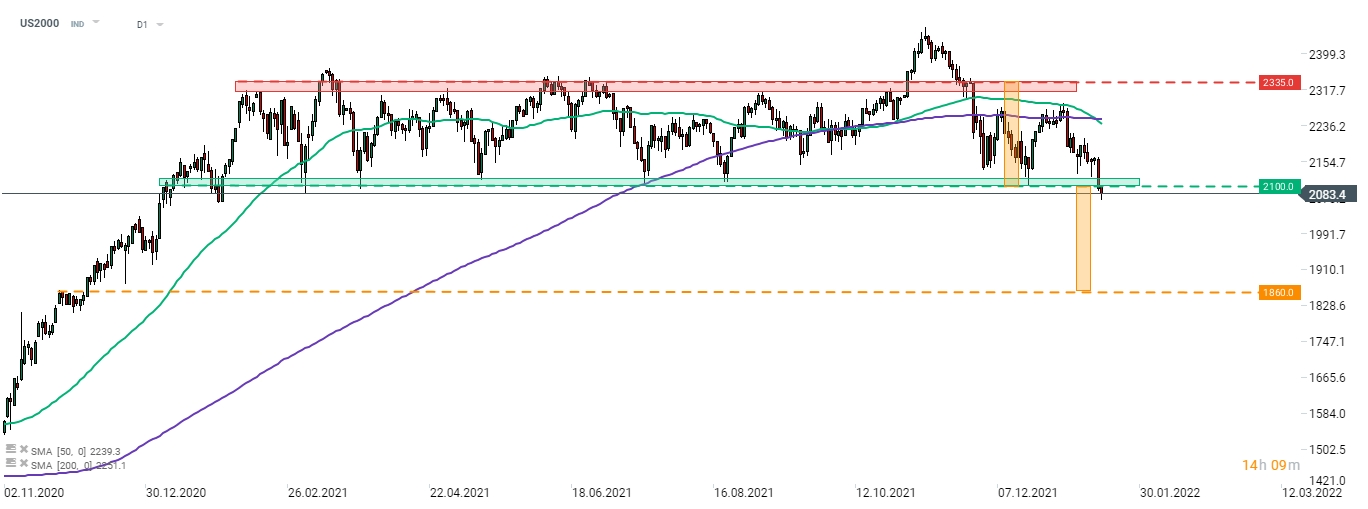

Market interest rates continue to rise with the US 10-year Treasury yield hovering near 1.9%. While higher rates are usually seen as negative for the tech sector that is often more indebted than other sectors, pick-up in yields is also negative for small caps. In fact, the small-cap index Russell 2000 has a debt-to-equity ratio of around 129% while this ratio for Nasdaq or S&P 500 stands at 89.5% and 114.5%, respectively. Dow Jones is even more indebted but a high share of financial institutions, like banks, cushions the index from a hit from higher rates.A break below the lower limit of Russell 2000 trading range that can be observed at press time was trigger by hawkish shift in Fed's policy but whether this breakout translates into a bigger sell-off will depend on whether Fed delivers on hawkish expectations.

Taking a look at Russell 2000 chart (US2000), we can see that the US small cap index dropped below the lower limit of a trading range today. In spite of other Wall Street indices reaching new all-time highs regularly, US2000 has been stuck in a 135 points wide consolidation for a year! Now this index is threatening to deliver a downside breakout from the pattern and according to classic technical analysis, such a scenario may herald a 135 points drop. This would push the price down to 1,860 pts - the lowest level since early-December 2020.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.