US100 (Nasdaq 100) rebounds by 0.50% to 19,400 points today after yesterday's declines following Nvidia's quarterly report release. The futures on the technology index closed yesterday with a drop of over 2.00%, despite the report exceeding analysts' expectations.

The initial reaction to the results was mixed, but afterward, the bears took control of the market, leading to declines. This shift in sentiment was observed across all major tech companies and in the AI sector. Although the results were solid, investor expectations were clearly higher. Today, we see a slight rebound in the US100 index, which may continue after the cash session opens. The aggregated analyst recommendations indicate an average index price of 22,145 points over the next 12 months. Considering a potential growth of 14.5%, this is quite substantial. Historically, analyst recommendations have suggested a growth potential of around 10%.

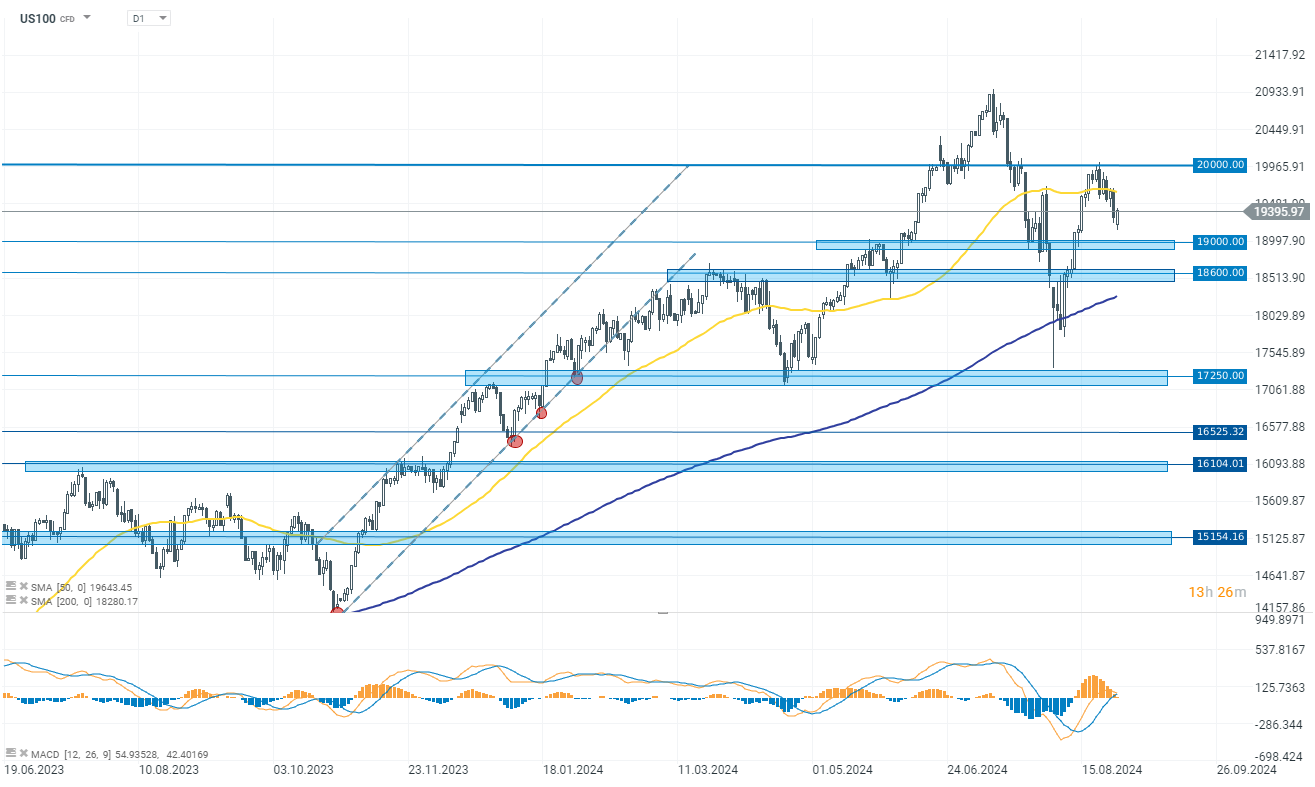

The tech stock index is gaining 0.50% today, reaching 19,400 points at the time of publication. From a technical analysis perspective, the most important level for the bulls to break remains the 20,000-point zone, where the recent upward movement was halted. On the other hand, if the declines continue, the key support zone to watch is around the 19,000-point level.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.