A new week has begun and there is still no agreement on the US debt ceiling. Moreover, comments made by Democrats and Republicans suggest that two sides grew more apart in their positions over the weekend. Nevertheless, talks are still ongoing and US president Biden is set to meet with House Speaker McCarthy today to look for solutions. US Treasury once again warned that deadline to reach the agreement is June 1, 2023 and failure to do so by then could risk US defaulting on its obligations. Goldman Sachs assesses that US default would happen on June 8-9, 2023 without an agreement.

Deadline to reach the deal is looming large but, interestingly, markets barely reacted to the latest setbacks and launched new week's trading little changed. This shows that there is a strong belief in the markets that the deal will eventually be reached and sides to the negotiations are just trying to win as many concessions from the other as possible. Nevertheless, failure to reach a deal this week could see markets start to get nervous.

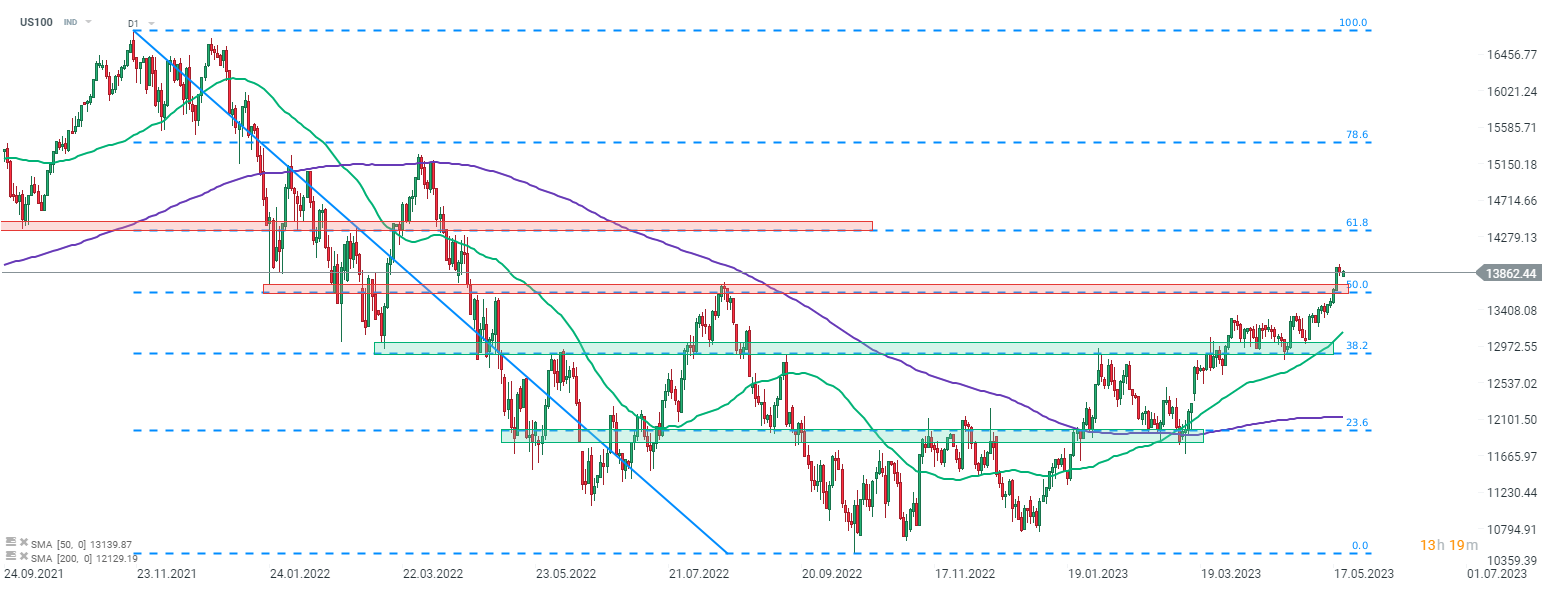

Taking a look at Nasdaq-100 futures chart (US100) at D1 interval, we can see that the index reached a 13-month high last week. While a small pullback occurred last week, price remains close to recent high. While markets seem to ignore negative news on debt ceiling negotiations, it does not mean that positive news will be similarly ignored. Headlines suggesting that definite agreement was reached would likely trigger a positive reaction on indices with US100 possibly moving above 14,000 pts. Apart from debt ceiling talks, US tech index may also move on FOMC minutes (Wednesday, 7:00 pm BST) this week or Nvidia earnings (Wednesday, after market close).

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.