Wednesday is unquestionably the most interesting day this week from market's perspective. Investors will be offered FOMC minutes at 7:00 pm GMT. The document will relate to the January 30-31, 2024 meeting, during which Fed Chair Powell said that the central bank may not have enough confidence in inflation by the March meeting to cut rates. Traders will look for more hints on what can be seen as 'enough confidence'. However, there will be another event this week, which will be watched even more closely than FOMC minutes release - fiscal-Q4 earnings from Nvidia (NVDA.US). Report will be released after close of the Wall Street session at 9:20 pm GMT and will show whether Nvidia's business performance lived up to the hype that has pushed the company's shares to all-time highs. Expectations going into the report are very high, and failure to deliver on them and provide an optimistic outlook for the coming quarters may be a huge disappointment. Earnings disappointment may put Wall Street rally at risk given that Nvidia was its backbone.

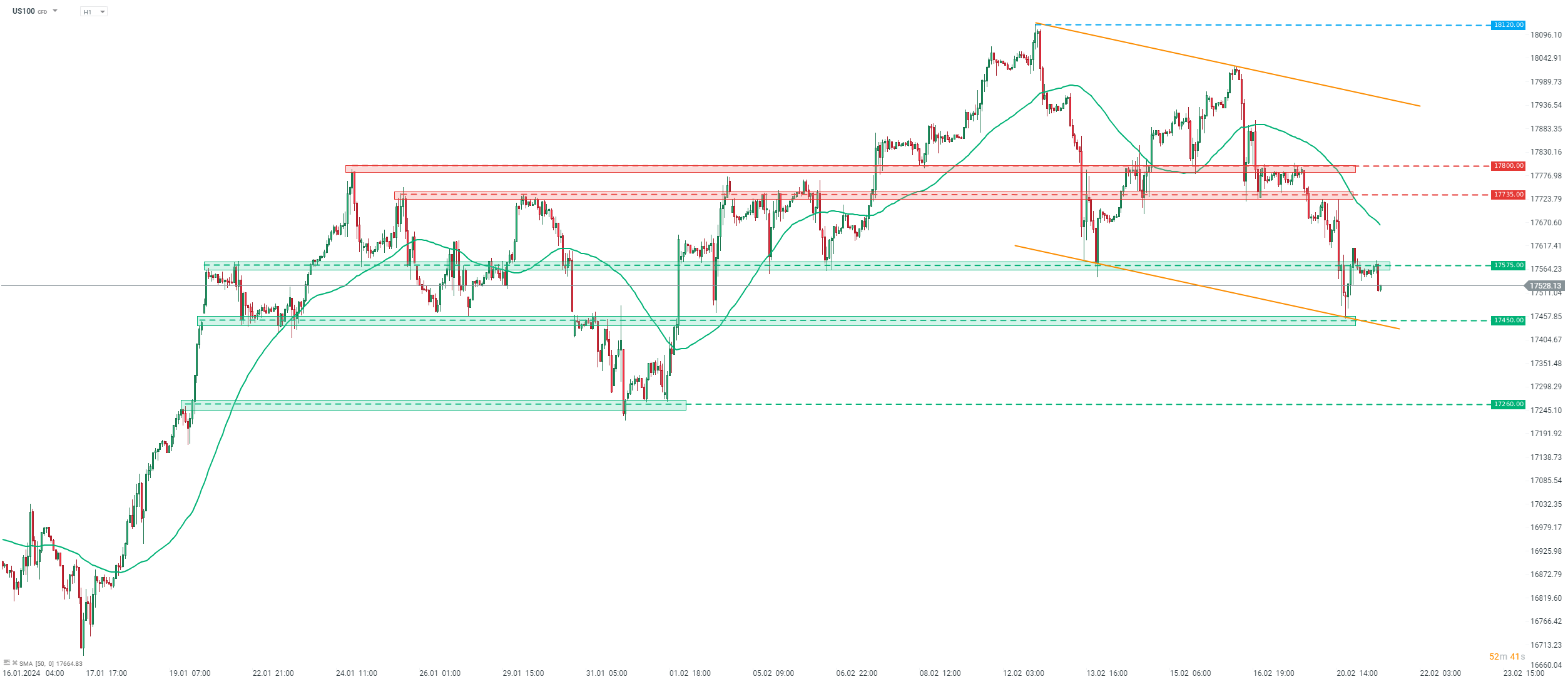

Taking a look at Nasdaq-100 futures chart (US100) at H1 interval, we can see that the index reached fresh record highs in the 18,120 pts area at the beginning of the previous week, but has been struggling since. Index is trading over 3% below recent all-time highs and has broken below the 17,575 pts support zone. A test of the 17,450 pts support area was made yesterday but bears failed to break below it. The aforementioned 17,450 pts area is a key near-term support to watch, given that US100 was unable to break back above 17,575 pts area overnight. A solid report from Nvidia is likely to push the stock, as well as the whole tech sector, higher while a disappointing report may exert strong downward pressure on US100 and push it towards 17,260 pts support.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.