Among the FOMC members, opinions regarding the next interest rate hike are now divided. From some bankers' comments, we learn that the current level is sufficiently high to bring inflation to target and cool down the economy - this is the view of, for example, Harker. On the other hand, the remaining bankers remain hawkish, signaling another rate hike at the December meeting. Waller made such comments yesterday.

In the market for 10-year US Treasury bonds, rising yields suggest that the market expects another interest rate hike. The decline in bond prices, and consequently, the increase in their yields, is surprising, especially in the context of rising geopolitical tensions between Israel and Hamas. Gold has risen over 7.0% since the onset of the war, justifying the capital flight to less risky assets. However, in the bond market, instead of price increases, we see deepening lows.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app

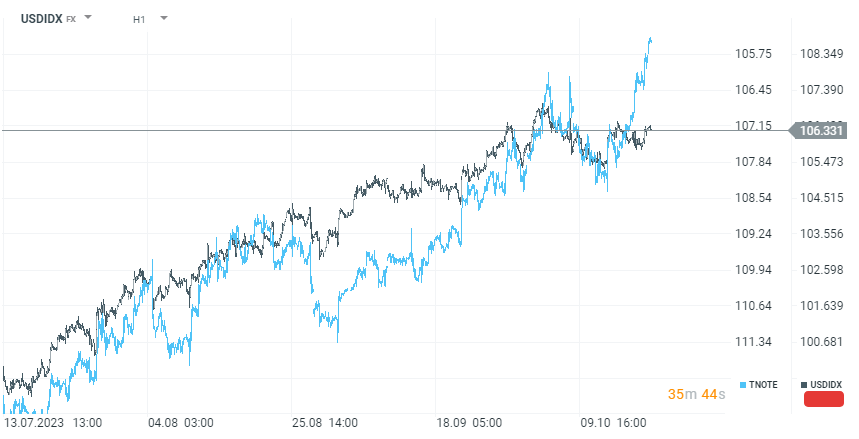

Such a situation may not last much longer. On the chart comparing the inverted price of 10-year bonds with the dollar index, we see a significant deviation. The dollar remains strong but does not justify such sharp drops in bond prices (inverted graph). We potentially have only one more interest rate hike in December. This would suggest that the downward movement for bond prices may already be limited.

On a weekly interval for the 10-year bond price quotations, we can notice that we are currently approaching very close to the lows reached just before the 2008 crisis. The index reached a level of 104.5 points then, which is only 1.0% lower than current levels.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.