Swiss banks are in the center of news attention at the beginning of a new week. UBS agreed to buy Credit Suisse in a government-brokered deal aimed at restoring calm and confidence in the European banking sector. UBS will purchase Credit Suisse for 3 billion CHF and receive additional 9 billion CHF in government guarantees. On top of that, additional liquidity to a combined entity will also be provided. Government guarantees to UBS should not come as a surprise given that the bank will also assume around 5 billion CHF in Credit Suisse losses.

UBS takeover of Credit Suisse leads to an interesting and potentially dangerous situation in the Swiss banking sector. Tie-up of two largest Swiss banks means that over 50% of bank deposits in the country will be held by a single institution! This is a massive concentration and could have grave consequences for Swiss banking sector stability should UBS encounter a bank run. However, UBS is not Credit Suisse and has a much better record of not getting involved in market scandals and other suspicious activities. Not to mention that Swiss regulators are likely to pay double attention not to let this behemoth fail. On the other hand, it means that once current turmoil is over, discussions about splitting up UBS may commence.

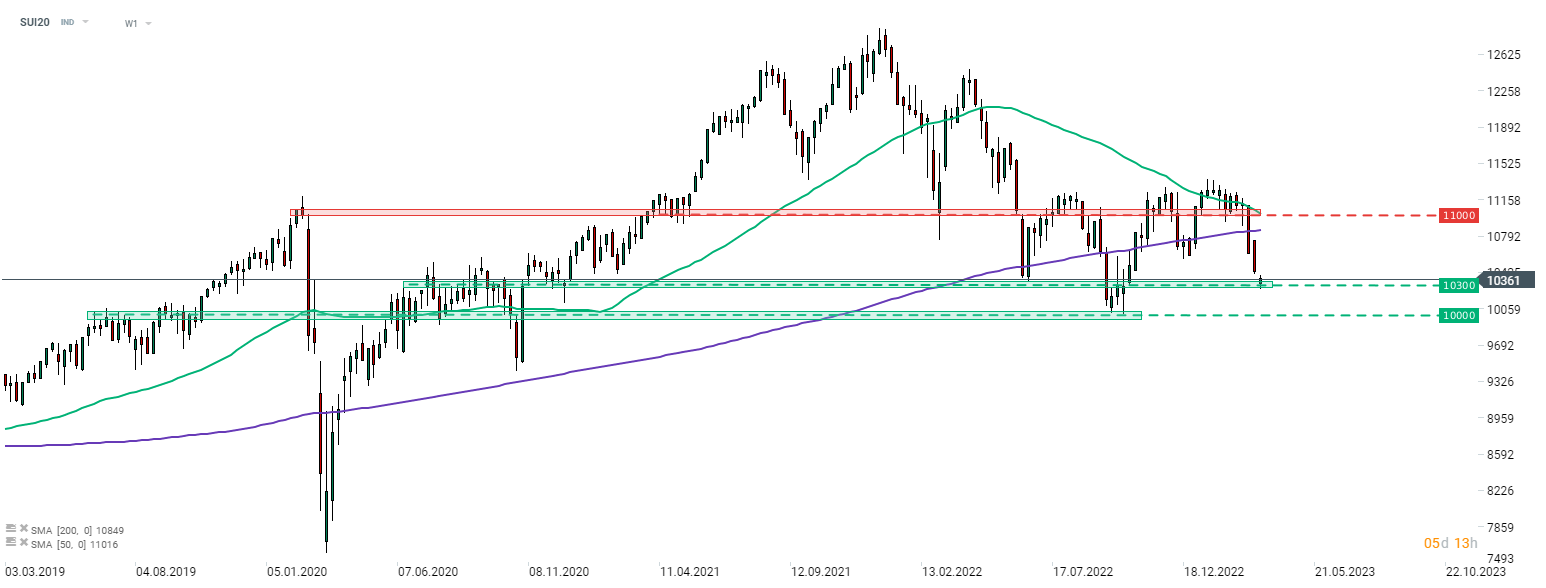

In spite of being two largest banks in Switzerland, Credit Suisse and UBS had a less than 10% combined share in SMI (SUI20) - index of 20 largest Swiss stocks. This index is dropping slightly over 1% today and is one of Europe's top laggards. Taking a look at SUI20 chart at weekly interval (W1), we can see that the index launched a new week with a bearish price gap and tested the 10,300 pts support zone. Bulls managed to defend the area on the first attempt and now attempt to launch a recovery move.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.