The FOMC meeting yesterday did not bring any surprises in terms of policy decisions. Interest rates were left unchanged as well as size and pace of QE programmes. Moreover, there was no mention of taper talk and Powell said that no such discussions are expected in the near future. Fed chair noted that inflation runs high but has once again claimed that it is transitory and there is no need to act. This hints at a continued period of record low real interest rates, which has hurt USD and benefitted precious metals.

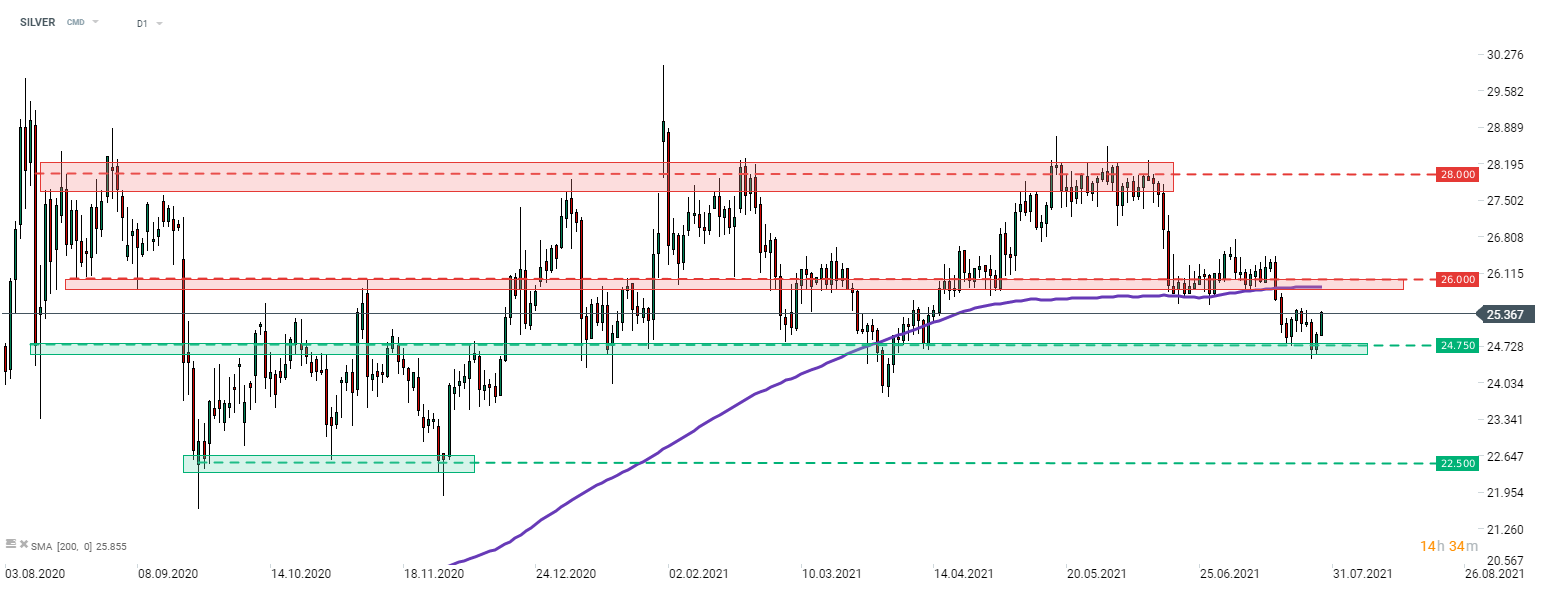

SILVER managed to bounce off the mid-term support at $24.75 yesterday and the upper move is continued today. The nearest resistance zone can be found in the $26.00 area, where 200-session moving average (purple line) can also be found. Today's GDP report release at 1:30 pm BST is likely to have an impact on US dollar and therefore may also impact precious metals.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.