A lot of attention at the start of a new week is paid to oil, which launched today's trading with a big bearish price gap amid signs of potential de-escalation in the Middle East. However, there is also another group of commodities that is standing out today - precious metals. Gold continues to rally even in spite market expectations for Fed policy moves becoming less dovish after Friday's strong jobs data.

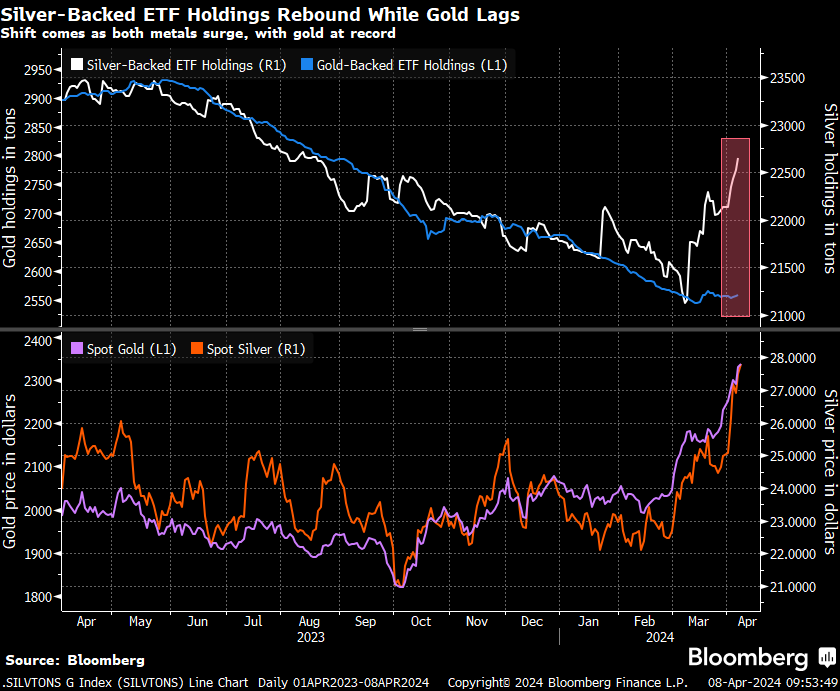

While gold is drawing the most attention among precious metals as it is trading at record highs, silver also deserves a note. SILVER is the best performing precious metal today, gaining around 1.7% at press time. Gold seems to be driven mostly by expectations of easier monetary policy from major central banks, especially Fed, as data on ETF holdings does not show any increase in demand for gold from such institutions. The situation looks different when it comes to silver, with ETFs noticeably increasing their physical silver holdings since the beginning of March.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

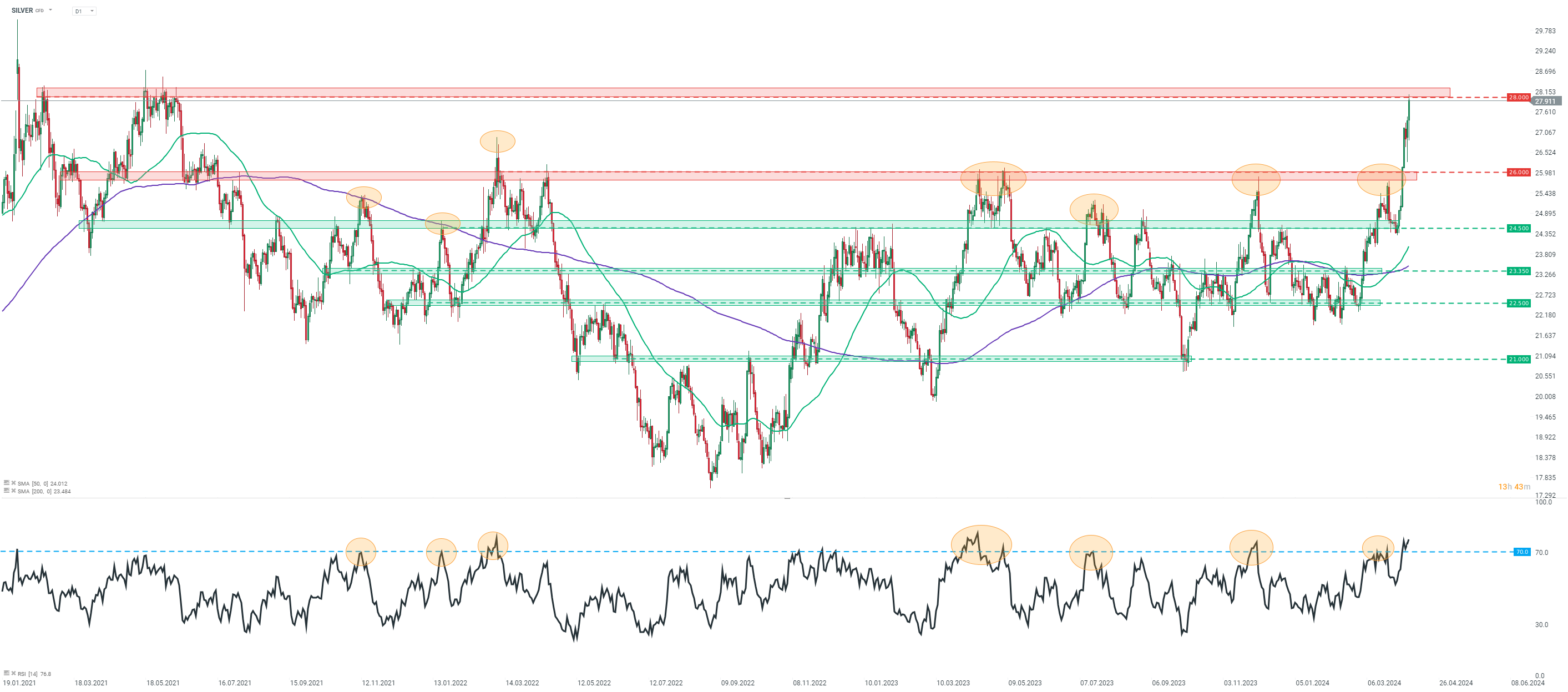

Taking a look at SILVER chart at D1 interval, we can see that the commodity broke above the $26 resistance zone last week and continued to rally afterward. Precious metal tested resistance zone ranging above $28 mark today and reached the highest level since June 2021. However, bulls were unable to break above the area and a small pullback occurred. Nevertheless, price remains nearby and another attempt to break above the $28 area cannot be ruled out. However, it should be noted that 14-day RSI indicator sits above 70.0 level, which was associated with local highs in the past, so bulls should stay on guard.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.