Oil price ticks higher due to a combination of factors impacting both supply and demand. Positive US economic growth and Chinese stimulus measures have boosted demand expectations. On the supply side, tensions in the Middle East, particularly the attack on an oil tanker in the Gulf of Aden and concerns over disruptions in oil supply, have added support to oil prices. Additionally, a significant drawdown in US crude stockpiles suggests tighter supply, further pushing up prices. This is also complicated by rising a geopolitical risk, following the drone strike by Iran-backed militants in Jordan, which killed three US troops and the strike of a fuel tanker in the Red Sea.

- Middle East tensions, particularly the Houthi military operation targeting an oil tanker in the Gulf of Aden.

- Three American soldiers were killed and more than 34 were injured in a drone attack on a US military base on the Jordan-Syria border. Biden stated that the attack was organized by "radical militant groups supported by Iran” and retaliatory actions are planned.

- Increase in US oil rigs as reported by Baker Hughes, indicating potential changes in oil production levels.

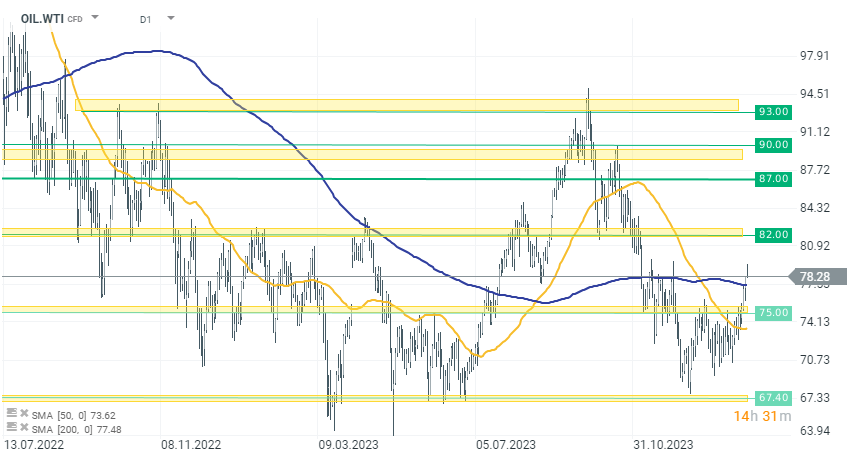

Looking at the oil prices (OIL.WTI), we observe a rebound in prices after the formation of a double bottom around $67.40 per barrel. After the breakout, the price surpassed another resistance at the $75 level, which is currently the nearest support zone. From below, oil quotes are still supported by the 200 SMA average. The nearest range or resistance of the current upward movement is the $80-$82 per barrel zone.

Source: xStation 5

Economic calendar: NFP data and US oil inventory report 💡

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.