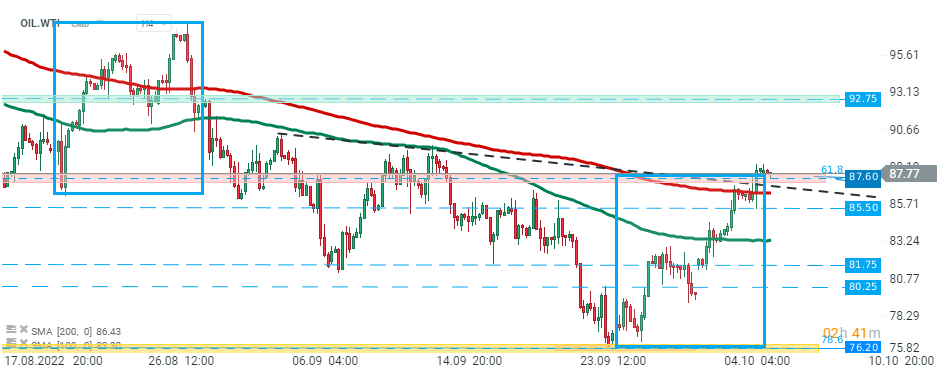

WTI crude futures traded near $88.00 per barrel on Thursday, having rallied more than 10% so far this week as OPEC+ agreed to cut output by 2 million barrels per day, the biggest output cut since the start of the pandemic. Yesterday the price broke above the major resistance zone around $87.60, which is marked with upper limit of the local 1:1 structure, downward trendline and 61.8% Fibonacci retracement of the upward wave launched in December 2021. As long as price sits above this level, upward move may accelerate towards next resistance at $92.75.

OIL.WTI, H4 interval. Source: xStation5

OIL.WTI, H4 interval. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.