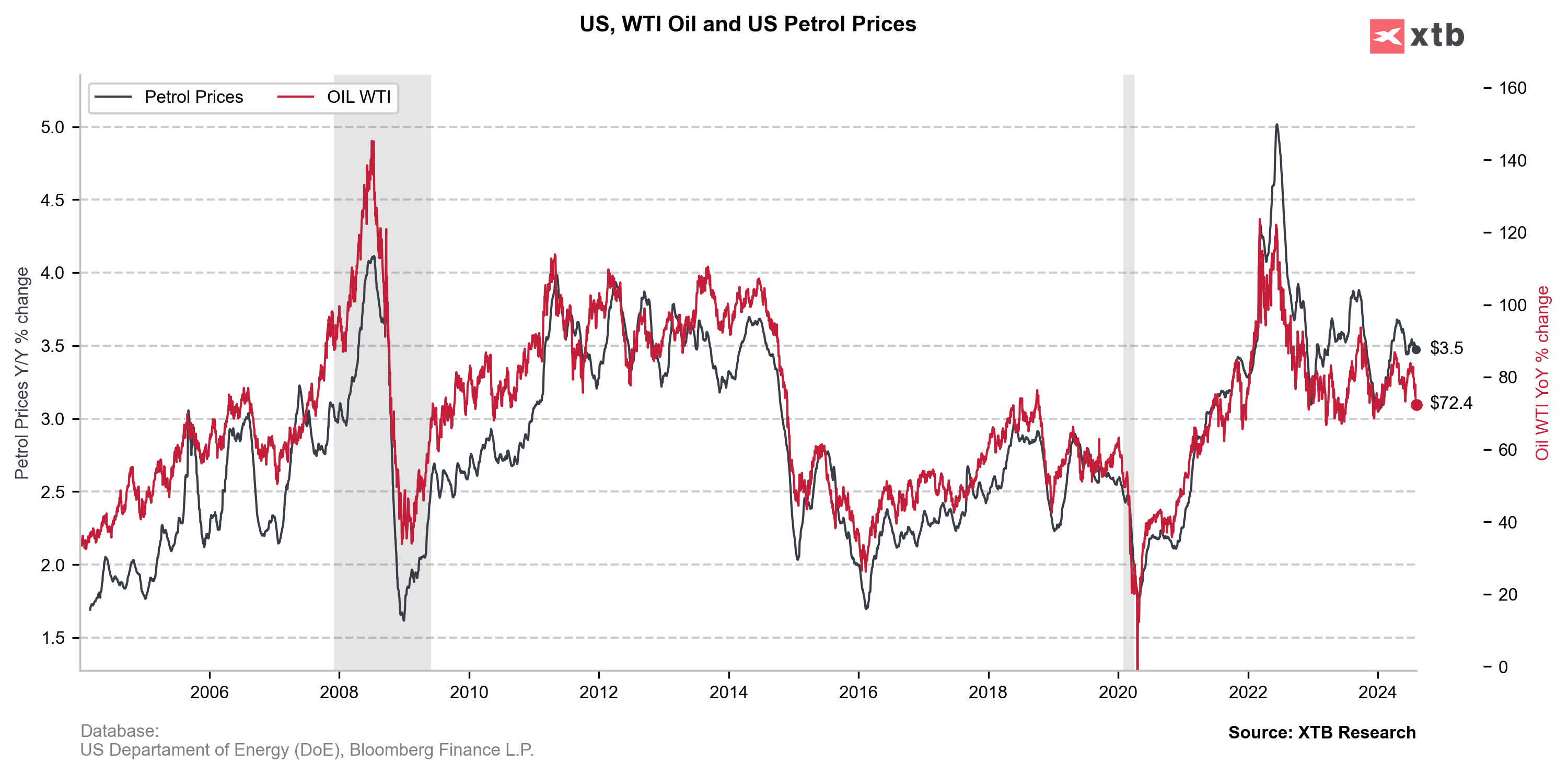

WTI crude oil is losing 2.80%, falling below $72 per barrel, erasing the recent risk premium from the escalation of the conflict in the Middle East. The catalyst for the decline is concerns about an upcoming slowdown in the US and a drop in oil demand.

The decline is occurring despite increased geopolitical risk in the Middle East, where tensions related to potential retaliatory actions by Iran against Israel have raised concerns. However, these geopolitical factors were not sufficient to counterbalance the broader market sell-off and fears of economic slowdown, particularly in the US and China.

The low oil prices are favorable for the Fed and the further cooling of inflation in the US. Therefore, recent declines may increase investor expectations regarding the number of interest rate cuts by the Fed later this year.

Oil prices have dropped more than 8.80% over the last three trading sessions since last Thursday. The drop from levels above $78 is currently testing the $72 per barrel mark. Hedge funds have significantly reduced their net long positions in futures contracts, indicating a bearish outlook for the oil market. If the downward pressure continues, the next target range for the current decline could be around $67.50-68.00.

Source: xStation 5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.