The oil market has recently experienced a strong sell-off, spurred by concerns over the macro health of the US economy, from which weaker data has 'joined' long-observed weak data from Europe and Asia (especially China). Oil has failed to halt declines despite the expected escalation of tensions in the Middle East, with Brent prices hovering around $77 per barrel, after a rebound from $75 lows, although an Iranian attack on Israel according to many sources seems inevitable.

- It's hardly surprising that the market 'slept through' the possible flare-up of a broader regional conflict in the Middle East, following several, weaker macro readings from the US. Today, however, we are seeing a near 1.5% rebound in oil, and if the market begins to price in 'firmer' readings from the US (tomorrow's claims at 2:30 pm), with the risk of war rising, oil contracts could return above $80 per barrel.

- We have a situation where the market will either see another weak macro data from the US and no significant escalation in the Middle East, which could lead to resignation and a test of the May 2023 minima at $72 per barrel, or a war between Israel and Iran (an OPEC member) will eventually occur, causing tighter supply and a rebound in prices, even if macro data from the US fill the markets with uncertainty.

- At this point, Wall Street is not showing that it expects anything other than continued, repeated attacks by Huti, Hamas and Hezbollah militants. According to Reuters sources, anonymous sources with ties to the U.S. were said to be pressuring Israel not to decide on an escalatory response, to a possible Iranian attack, expected next Monday, or Tuesday.

- Stopping the war in the Middle East now seems crucial for U.S. diplomacy, ahead of the presidential election (keeping oil prices under control), and Trump's win could result in stronger U.S. involvement, in a possible war with Iran - if it decides to launch a full-scale attack. Oil prices show that the market does not see this scenario as likely at present, while if it materializes - oil could rebound.

Lower production at the Sharara oilfield, Libya (300,000 barrels per day) has raised concerns about supply; Libya's National Oil Corp has said it will begin reducing production due to protests. However, the oil market continues to receive mixed data. The much-anticipated seasonal rebound in Q3 demand still appears disappointing at this point in the US, cushioned by fears of a supply glut in Libya. Consumption of road fuels such as gasoline and diesel fell below initially optimistic forecasts according to the data, analysed by Onyx Capital. Saudi Aramco reported a 3.4% y/y drop in net profit, although the company noted that market fundamentals do not support a price decline, and demand in China is growing. Also, roday Chinese import report came in much higher than expected, signalling potentially improving momentum for oil. Today at 3:30 PM GMT we will learn the change in inventories according to the EIA.

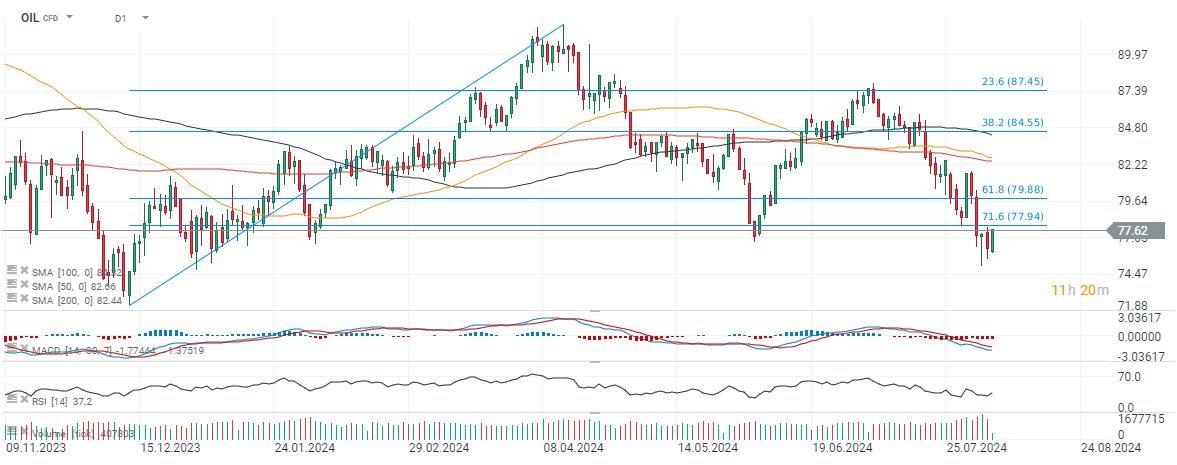

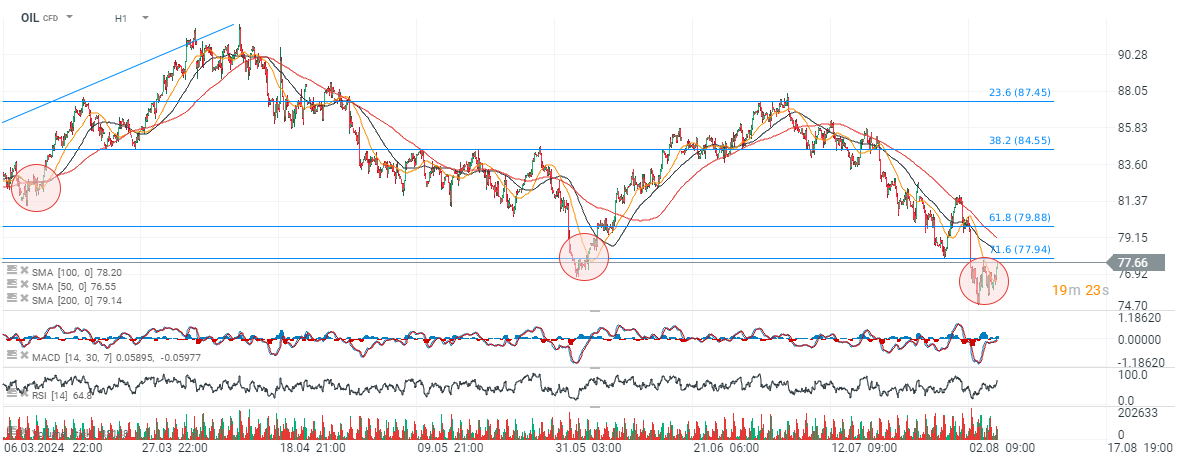

OIL (D1 and H1 chart)

Brent is approaching the 71.6 Fibonacci retracement of the December 2023 upward wave at $78 per barrel. The next key levels are between $79 and $82. Source: xStation5

Source: xStation5 Source: xStation5

Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.