OPEC+ is set to announce output levels for November today. Cartel's meeting will begin at 1:00 pm BST. Expectations are for a major production cut with markets positioning for a 1-1.5 million barrel reduction in recent days. However, media reports surfaced over the past couple of hours suggesting that a cut as big as 2 million barrels may be made. On top of that, UAE officials said that today's meeting will be groundbreaking and will see a change in OPEC+ policy. However, it should be noted that OPEC+ is already producing below an agreed-on quota and JPMorgan says that even if no agreement is reached, cartel members would still lower their production on their own. As such. JPMorgan expects oil prices to retest $100 per barrel area in the final quarter of 2022. Meanwhile, UBS said that with such high output cut expectations, a reduction smaller than 0.5 million barrels could be seen as negative for prices.

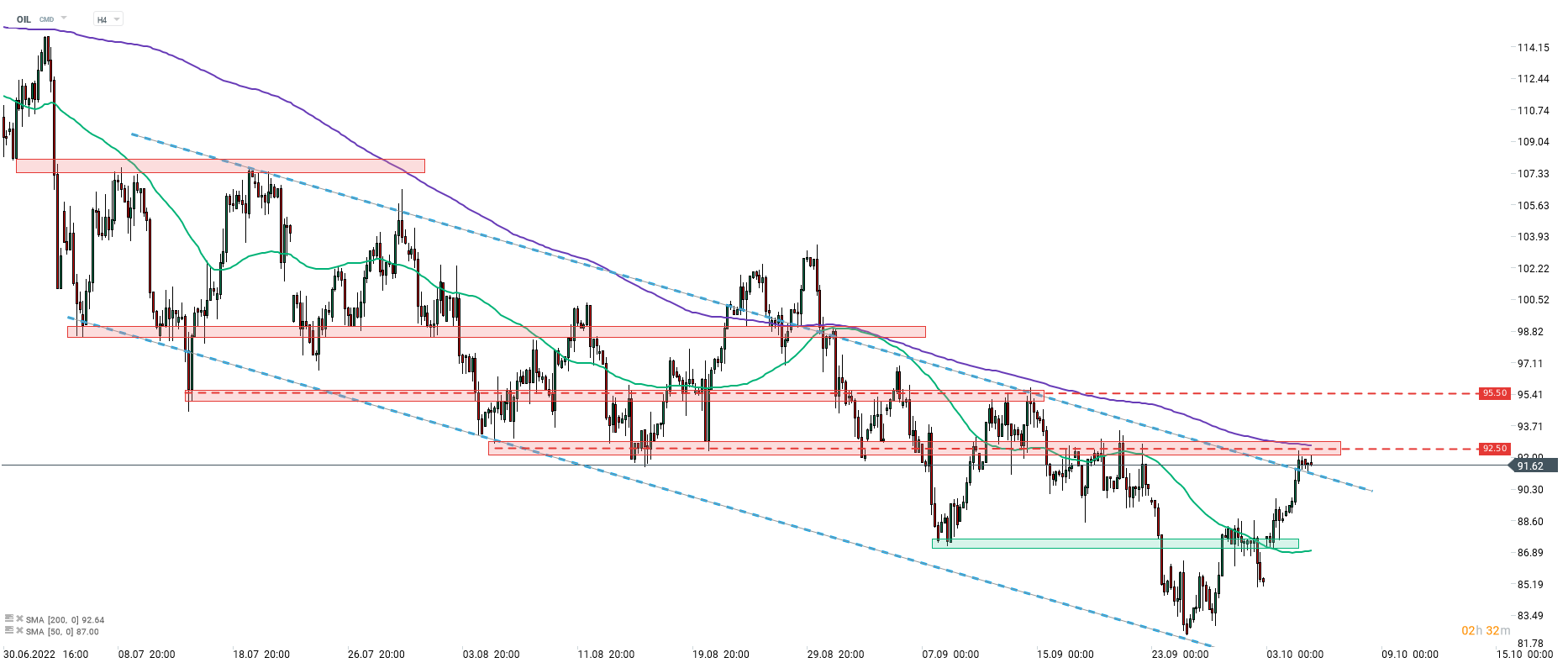

Taking a look at Brent chart (OIL) at H4 interval, we can see that oil price has been trading in a downward channel for some time. A break above the upper limit of the channel occurred this week. However, advanced was halted later on as price started to struggle near $92.50 support zone. Some sideways trading can be spotted since suggesting that market is in wait-and-see mode ahead of OPEC+ decision.

Source: xStation5

Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.