The New Zealand dollar has been a solid performer among G10 currencies as of late. However, the US dollar performed even better, leading to a big drop on the NZDUSD market over the past 4 weeks. The pair will remain in the spotlight this week, thanks to important events on the US-side as well as NZ-side. When it comes to US dollar, market is still waiting for the announcement from US President Biden on who will be the next Fed Chair. Biden is scheduled to deliver a speech on the economy and inflation tomorrow. As White House wants to announce the decision on Fed Chair ahead of Thanksgiving (this Thursday), it looks like tomorrow's speech from Biden could include the announcement. When it comes to NZD, investors will be offered retail sales data for Q3 today in the evening (9:45 pm GMT) and a RBNZ rate decision on Wednesday (1:00 am GMT). A rate hike looks like a done deal but economists seem to be divided on the scale - 25 or 50 basis points. A 50 bp rate hike could provide a boost for NZD but a 25 bp rate hike is largely priced-in and should not be a mover.

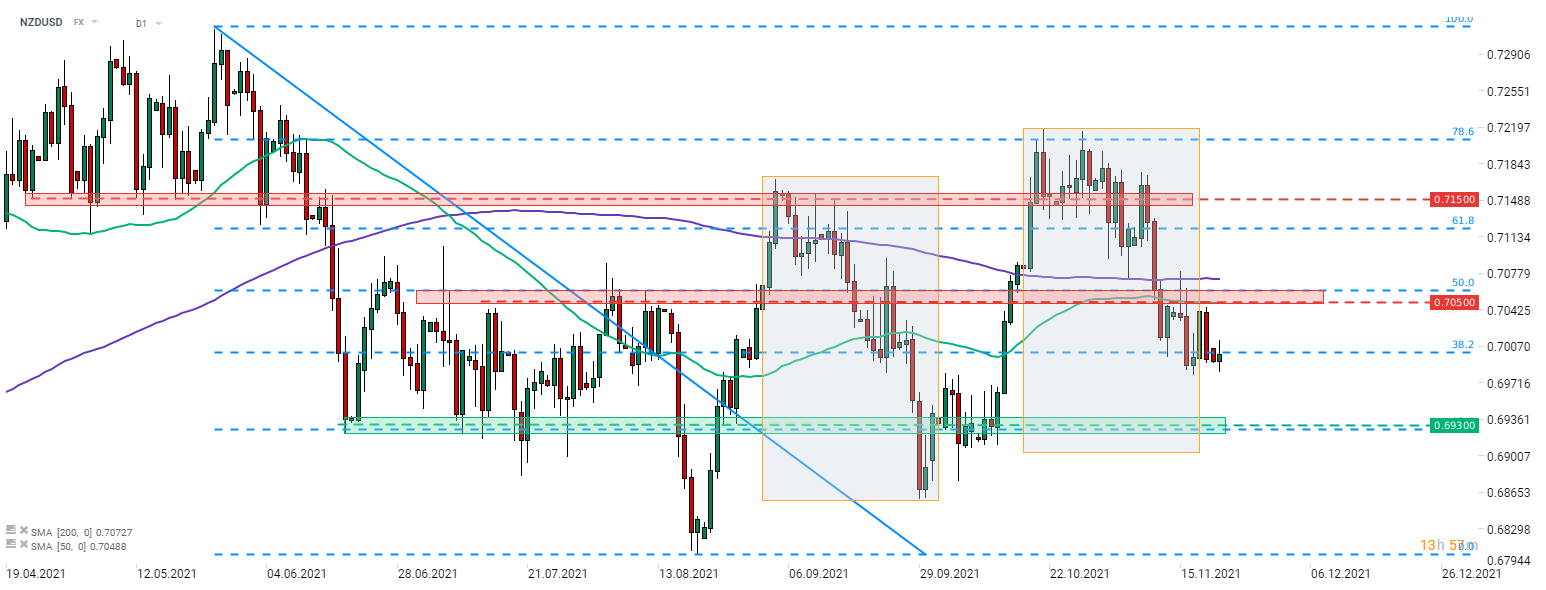

NZDUSD has halted a recent sell-off near the 38.2% retracement of the downward move started in late-May 2021. The lower limit of the market geometry in the 0.6900 area, marks a key near-term support. The nearest resistance zone to watch can be found ranging between 0.7050 and 50% retracement. Source: xStation5

NZDUSD has halted a recent sell-off near the 38.2% retracement of the downward move started in late-May 2021. The lower limit of the market geometry in the 0.6900 area, marks a key near-term support. The nearest resistance zone to watch can be found ranging between 0.7050 and 50% retracement. Source: xStation5

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appThis content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.