Reserve Bank of New Zealand decided to hike interest rates by 50 basis points. This put the Official Cash Rate at 2.50%, the highest level since January 2016. Such a move was expected and priced-in by the markets and some NZD profit taking could be spotted later on. The dip was brief, however, as RBNZ noted that it still plans to tighten policy further as inflation forecasts remain above Bank's target.

Another G10 currency - Canadian dollar - may also experience a jump in volatility today, thanks to a central bank decision. Bank of Canada will announce rate decision at 3:00 pm BST today. BoC has been mimicking Fed and as such a 75 basis point rate hike is expected. This would put the main interest rate at 2.25% - the highest level since October 2008. Governor Macklem will hold press conference at 4:00 pm BST and may provide some forward guidance. However, traders should not expect BoC policy to diverge much from Fed policy.

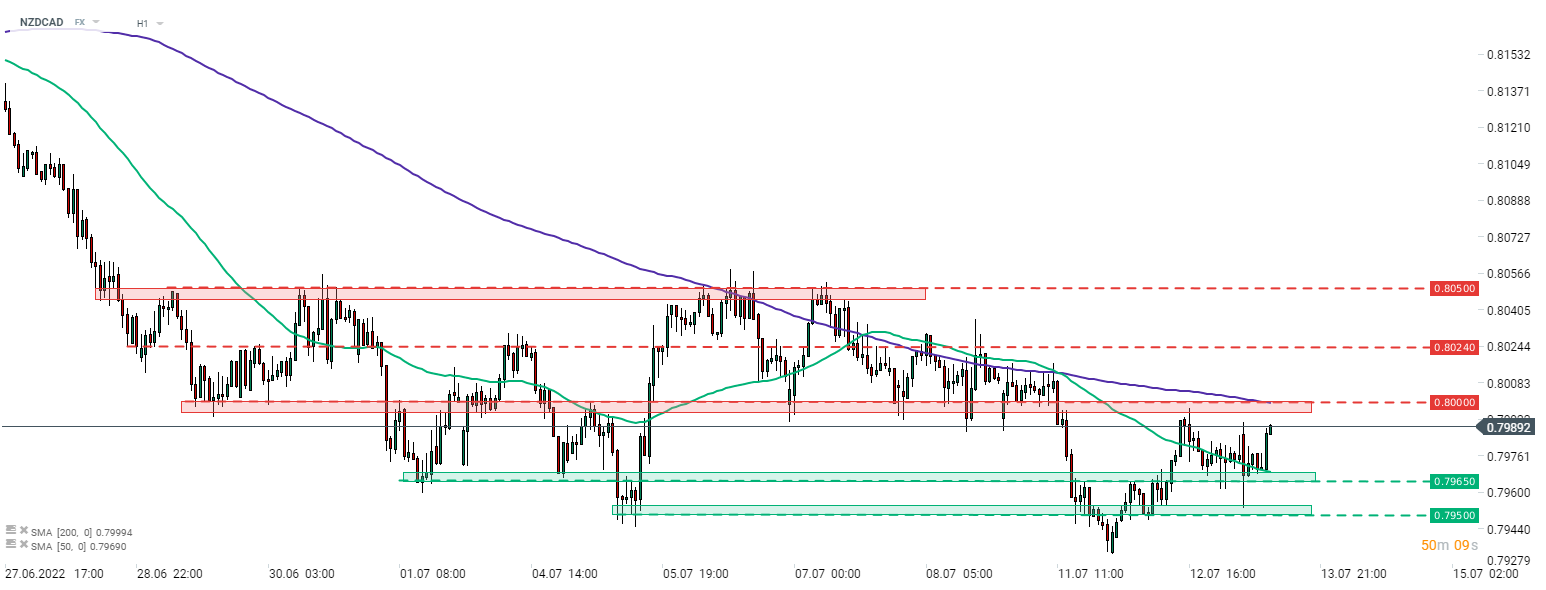

Taking a look at NZDCAD chart at H1 interval, we can see that the pair has been moving sideways since the end of June. Pair has recently climbed to and tested 0.80 resistance zone but failed to break above. After a brief pullback, bulls managed to regain control in the 0.79650 zone and another upward impulse can be observed at press time. Traders should expect the pair to become more volatile after 3:00 pm BST today.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.