Stock in the Asia-Pacific region rallied today, following strong gains on Wall Street yesterday. Japanese Nikkei 225 (JAP225) was a top performer in the region with a gain of 3% today. Index benefitted from an overall improvement in moods spotted on the global markets yesterday. However, there were some country-specific news that may have further sweetened sentiment towards Japanese shares. Namely, Japanese newspaper Yomiuri reported that Prime Minister Kishida is likely to go through with another round of fiscal support, in order to soften the blow from rising energy and goods prices. Details, however, are limited for now.

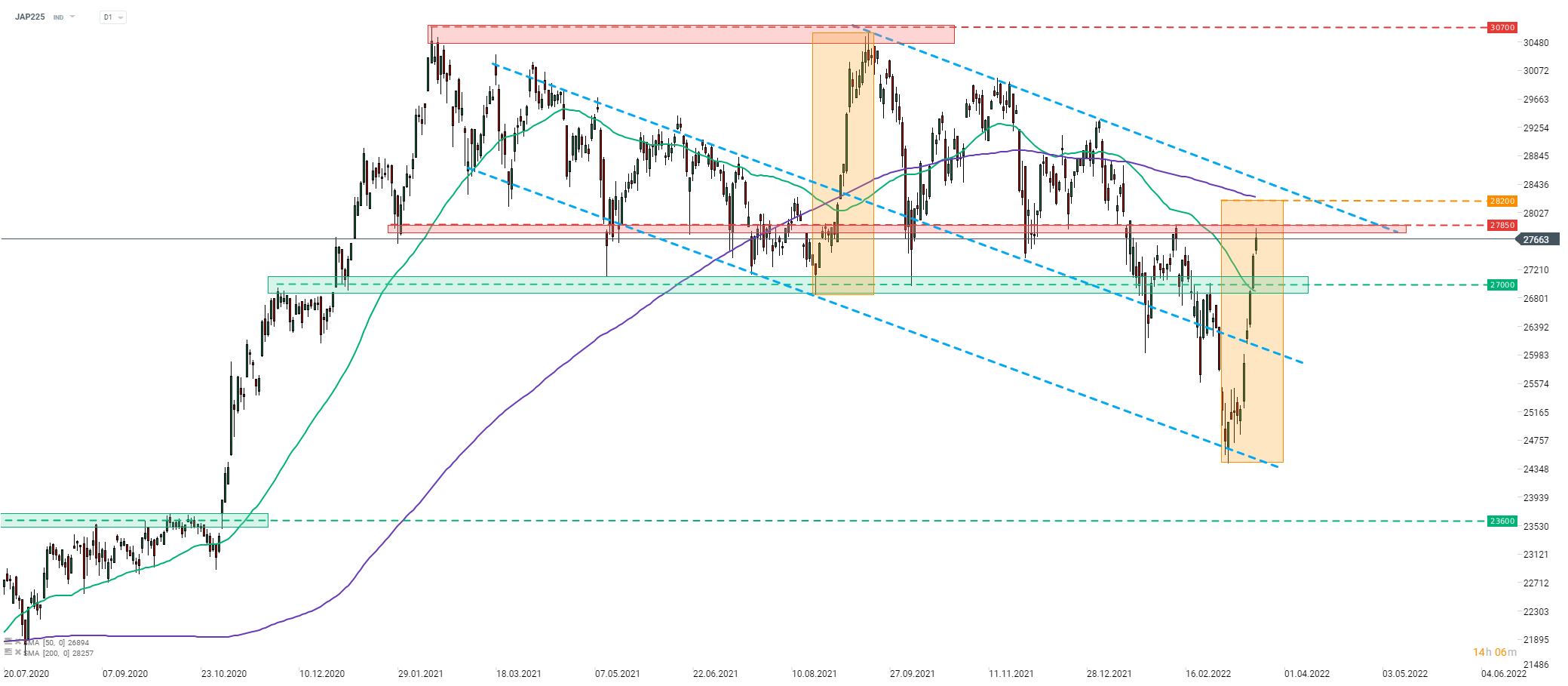

Taking a look at Nikkei chart at D1 interval (JAP225), we can see that the index has been trading mostly lower since the end of 2020. A test of the lower limit of a wide downward channel was made at the beginning of March 2022 but sellers failed to push the index below it. A recovery move was launched and JAP225 gained over 13% over the next two weeks. The two resistance levels to watch ahead are 27,850 pts resistance zone, which is being tested today, and the upper limit of an Overbalance structure at 28,200 pts. Note that the upper limit of the channel can be found slightly above 28,200 pts.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.