Composed largely of technology companies and susceptible to yen appreciation, the benchmark Nikkei (JAP225) slid more than 1% today, with contracts already retreating more than 2% ahead of the release of the US non-farm employment change, scheduled for 1:30 PM BST. A weakening dollar and a strengthening yen at the same time are putting pressure on Japanese exporters' earnings, leading to a repricing of many listed stocks, while a sell-off in the US semiconductor sector, led today by a nearly 10% sell-off in Broadcom (AVGO.US) is putting pressure on Japanese suppliers such as Advantest. The USDJPY pair is losing nearly 0.6% today, and US bond yields have fallen to record lows since the fall of 2023.

- U.S. labor market data published yesterday, for the most part (except for benefit claims), indicated that vacancies are declining (JOLTS), while the change in employment among private companies is down significantly (lowest reading since early 2021), and services, while still relatively strong, also saw a slowdown in the employment sub-index while the Challenger report indicated 75,000 layoffs in the U.S. economy, in August; breaking a record from the recession-filled Q1 2023.

- As a result, market expectations for a much higher change in non-farm employment (165k forecast vs. 114k previously) and a drop in the unemployment rate to 4.2% from 4.3% in July may prove to be exaggerated. If, on the other hand, we see better-than-expected data - we may see an improvement in sentiment in the stock markets, a strengthening of the dollar and a rebound in USDJPY - and by extension JAP225 contracts as well. So far, we see that fearful of a change in market dynamics, investors have reluctantly returned to the carry trade and liquidated bullish positions in the yen and Japanese benchmarks.

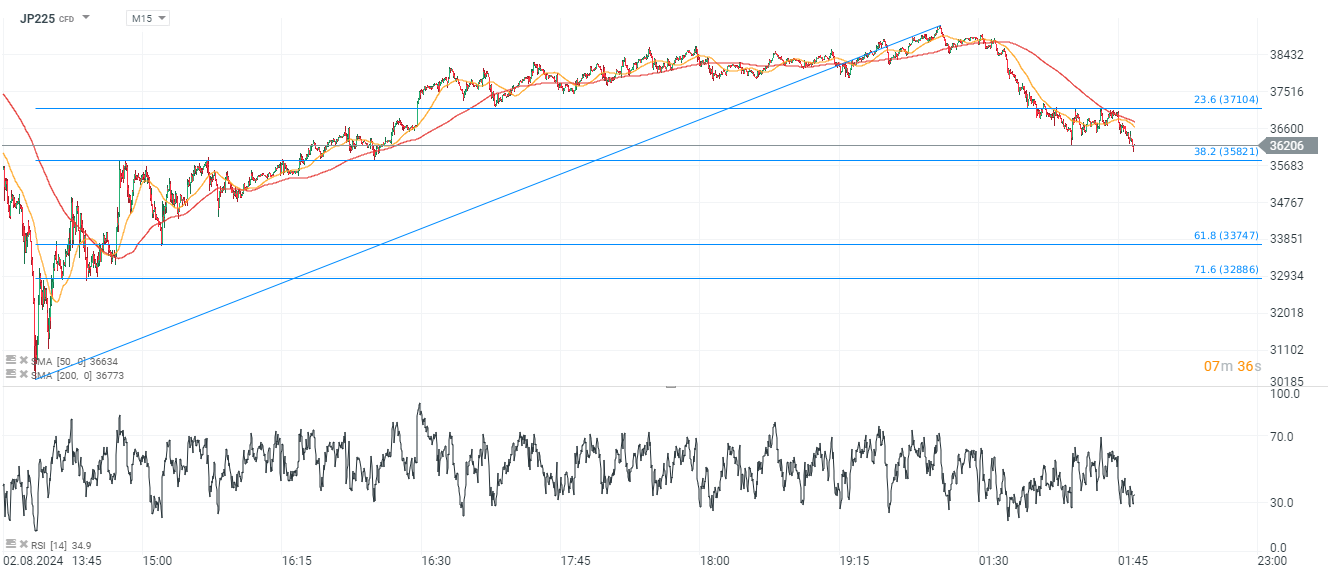

JAP225 (M15 interval)

Momentum after the rebound from the August lows has clearly weakened, and if the US NFP turns out to be weaker than forecast, further appreciation of the yen against the dollar and sentiment in the technology sector could successfully push the index below the 38.2 Fibonacci retracement at 35800 points.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.