The UK jobs report for August released this morning turned out to be better than the market had expected. Unemployment rate dropped from 3.6 to 3.5% while the median consensus was for it to stay unchanged at 3.6%. Wage growth also surprised to the upside with headline wage growth coming in at 6.0% YoY (exp. 5.9% YoY) while wage growth excluding bonuses accelerated to 5.4% YoY (exp. 5.3% YoY). However, the release failed to support GBP with the currency being among G10 top laggards and GBPUSD looking towards 1.10 handle again.

The Bank of England continues to try to calm the situation on the UK bond market but it is starting to look somewhat strange. Announcement was made today saying that the Bank will also purchase inflation-linked bonds (so-called linkers) as those have seen significant repricing at the beginning of this week. Why is it strange? Firstly, it is unusual for the UK central bank to purchase inflation-linked bonds as it was not done in any of the previous rounds of QE. Secondly, UK fiscal authorities will auction 900 million GBP worth of inflation-linked bonds this afternoon. So… BoE is buying linkers in the market propping up demand while the government is simultaneously selling them increasing supply. BoE bond purchases are set to end this week but with no major relief in sight and a risk of massive spike in bond market volatility after that, there is a chance that they will be extended at least until month's end when the medium-term budget is announced and some concerns over financing of massive tax cuts are alleviated.

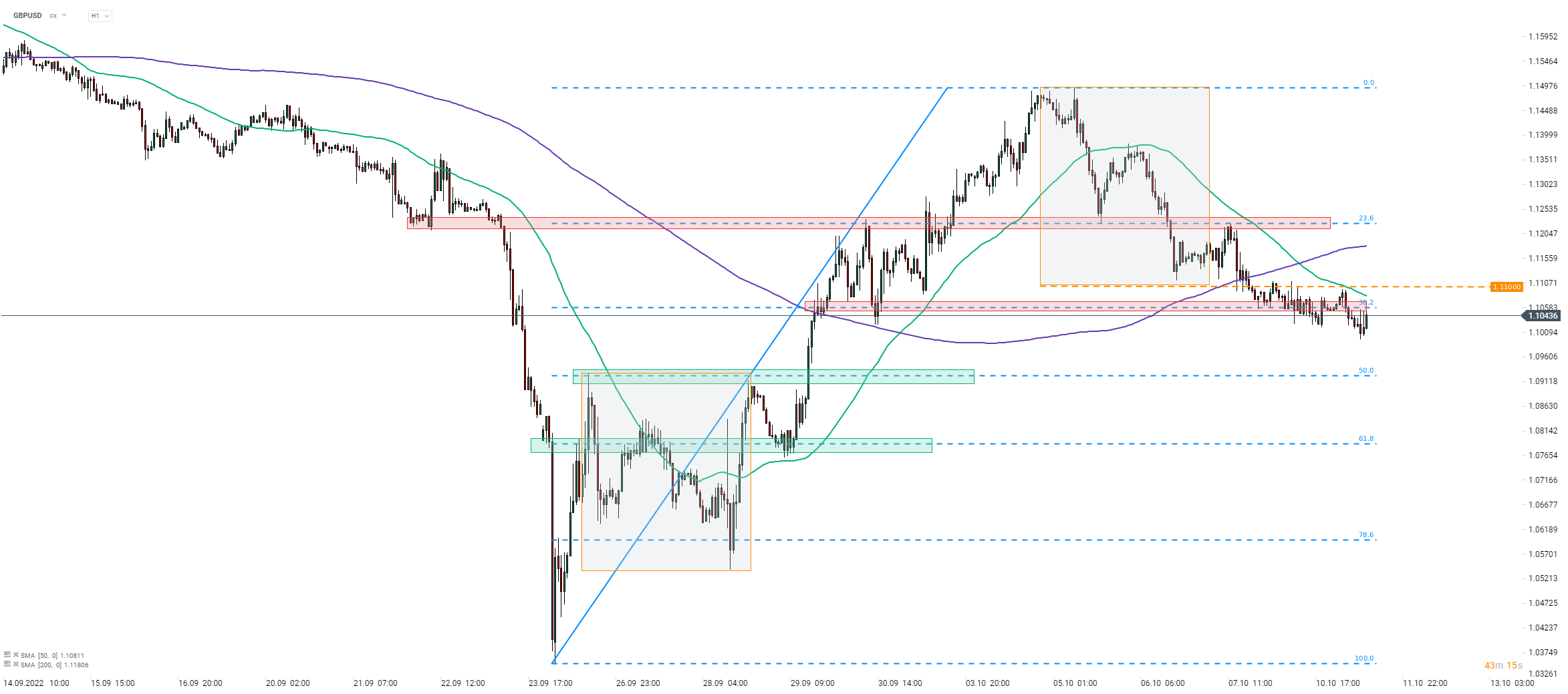

Taking a look at the GBPUSD chart at H1 interval, we can see that the pair seems to have ended the recent rebound. A drop below a 1.11 handle at the end of the previous week also meant a break below a local market geometry, signaling a potential end of a short-term trend. GBPUSD also broke below a swing level marked with 38.2% retracement of a recent upward impulse but attempts are made to climb back above. However, those were unsuccessful so far. Should a slide continue, the next support to watch can be found at 50% retracement in the 1.0925 area.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.