The British pound is pulling back ahead of the Bank of England rate decision, scheduled for 12:00 pm BST today. Economists polled by Bloomberg are almost unanimous that the Bank will decide on the second 25 basis points rate in a row. Money markets currently price in a 96% chance of such an outcome and only 4% of rates staying unchanged. Should the Bank of England deliver onto those expectations and hike rates by 25 basis points, the main rate would climb to 4.50% - the highest level since October 2008. However, as such an outcome is well expected and priced in, investors will look for hints on what comes next.

Should we see an increase in the number of MPC members who favor keeping rates unchanged, GBP may find itself under pressure. Last time, 7 MPC members opted for increasing rates while 2 preferred keeping them unchanged. Also, a new set of economic projections will be released and it will be closely watched, especially inflation forecasts. UK CPI inflation slowed in March but stayed above 10% YoY mark and should new forecasts show higher inflation expectations, it could be a bullish signal for GBP as it would hint at a need for more rate hikes. Markets currently see a rate peak at around 5.00% in September-November 2023.

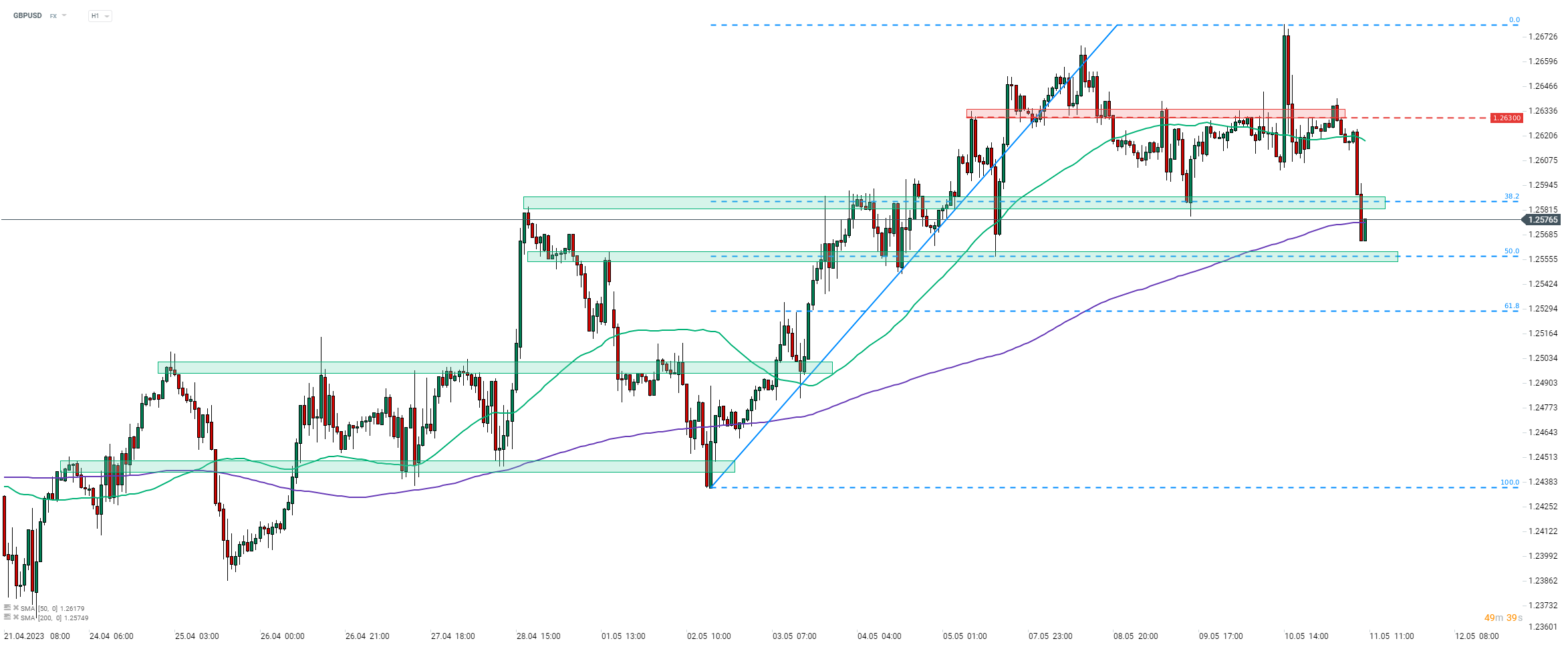

Taking a look at GBPUSD chart at H1 interval, one can see that the pair has been pulling back this morning. Pair dropped below the support zone marked with 38.2% retracement of the upward impulse launched on May 2, 2023 (1.2585 area). Downward move did not stop there with pair continuing to move lower and dropping below 200-hour moving average (purple line). An attempt to climb back above this moving average can be spotted at press time but should bulls fail to do so, the pair may look towards a test of the support zone marked with 50% retracement in the 1.2557 area.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.