UK inflation data for January was released today at 7:00 am GMT. Release showed a bigger slowdown in price growth than expected, with headline CPI gauge moving down from 10.5 to 10.1% YoY (exp. 10.3% YoY). Core gauge dropped from 6.3 to 5.8% YoY (exp. 6.2% YoY). Unsurprisingly, lower inflation reading was taken as dovish with investors increasing bearish BoE bets. This, in turn, triggered a pull back on GBP market.

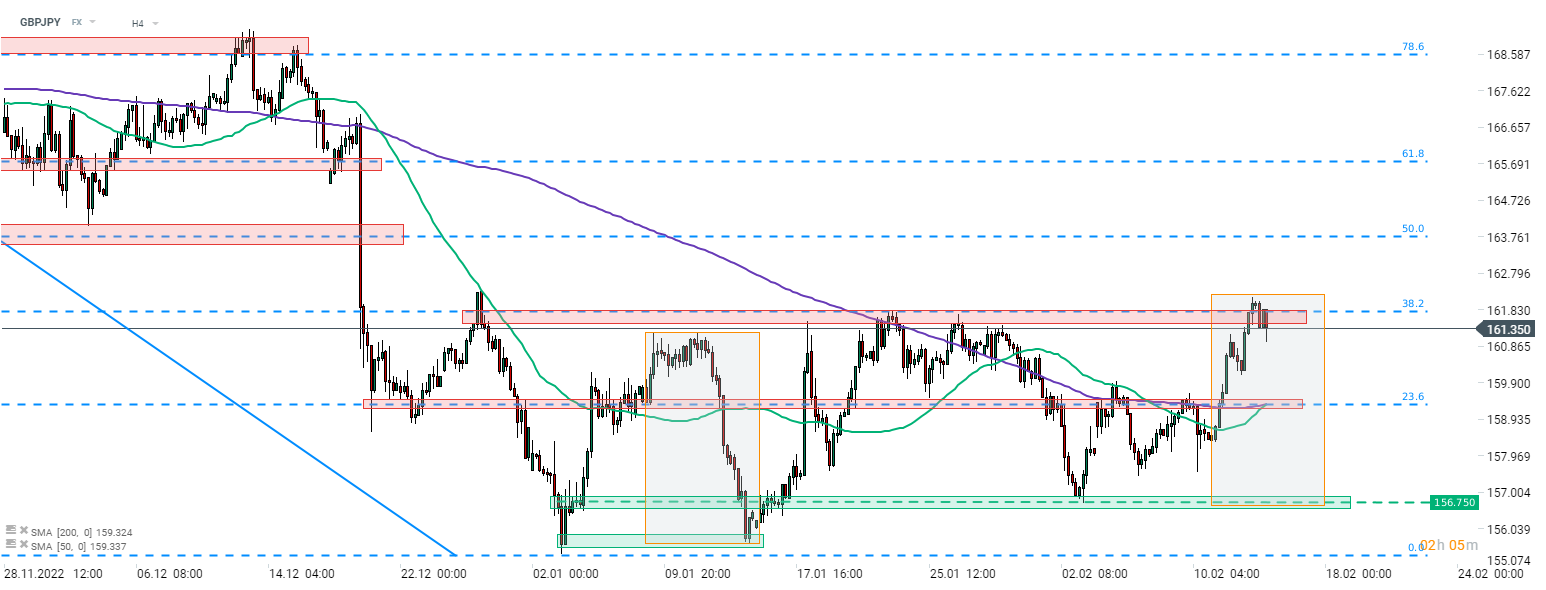

Taking a look at GBPJPY chart at H4 interval, we can see that the pair has managed to climb above the resistance zone ranging below 38.2% retracement of the downward move launched in October 2022 recently but this breakout was short-lived. Pair pulled back below it this morning but has bounced off the daily lows and it looks like another attempt to break above 38.2% retracement may be on the cards. However, if bulls fail and bears regain control, a deeper correction may be on the cards. In such a scenario, 156.76 zones will be a key support to watch. However, 23.6% retracement in the 159.30 area may also provide some support given that it saw numerous price reactions over the past 2 months.

Source: xStation5

Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.