The Reserve Bank of Australia (RBA) surprised markets with a dovish policy decision today. RBA left rates unchanged, with the main cash rate staying at 4.10%. Median consensus among economists surveyed by Bloomberg was for a 25 basis point rate hike. Meanwhile, money markets saw a less than 40% chance of a 25 bp rate move today. Ultimately, it turned out that the market was right and economists seem to have overestimated the impact of solid jobs data on RBA stance and underestimated impact of lower-than-expected Q2 CPI data. While statement released along with the decision did not rule out further hikes, there is a feeling that RBA may stay on pause now. Why? There is a number of reasons:

- Albeit still solid, labour market is loosening up

- Inflation trends develops better than expected

- Previous rate hikes are impacting economy, crimping demand

Having said that, RBA may want to stay on hold for now as its previous policy actions seem to be taking effect. Money markets also support this view - no change in the level of rates is priced in for September or October meetings.

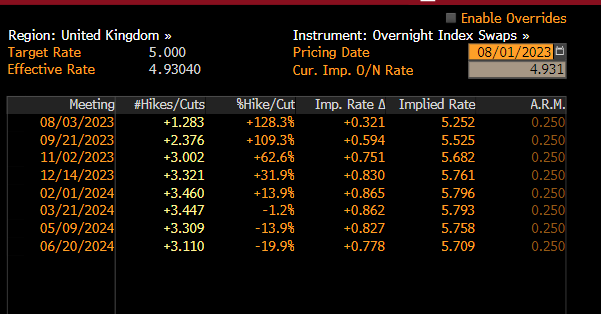

Traders will get to hear from one more central bank this week - Bank of England on Thursday, 12:00 pm BST. Economists also expected BoE to deliver 25 basis point rate hike, just as they did in case of RBA. However, in this case there is no disconnect between economists and money markets - money markets fully price in a 25 bp BoE rate move this week. Moreover, a total of three 25 basis point rate hikes is priced in for the next three meetings. The biggest risk for GBP seems to be a potential dovish turn from BoE, similar to Fed and RBA. However, it looks rather unlikely that given current economic picture in the United Kingdom, Bank of England will decide to stay on hold and issue a dovish guidance.

Money markets see 75 basis points of cumulative tightening over the next 3 BoE meetings. Source: Bloomberg

Taking a look at GBPAUD at H1 interval, we can see that a recent drop on the pair was halted at the 200-hour moving average (purple line) in the 1.9085 area. Pair rallied today, driven by AUD weakness, and has almost fully erased the aforementioned drop. A near-term resistance zone to watch can be found ranging below 1.9350 mark. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.