Release of US GDP data, flash CPI inflation from Germany and panel discussion with heads of Fed, ECB and BoE are all scheduled for today. While US data will be a revision and is not expected to trigger any big moves, inflation data from Europe and speeches from top central bankers may provide some volatility for EURUSD. Let's take a look at the technical situation on the main currency pair.

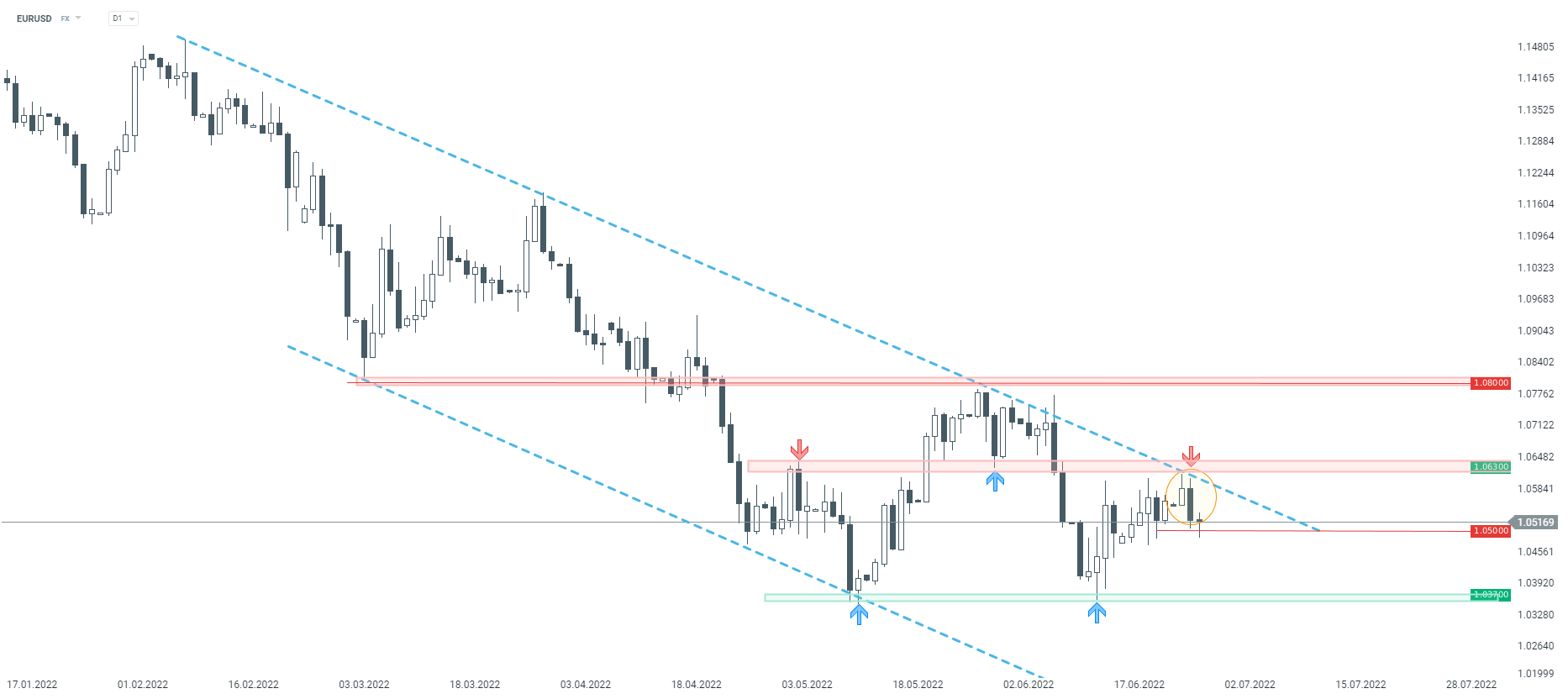

Taking a look at EURUSD chart, we can see that the pair has been trading in a downward move for some time. Even as buyers managed to paint a double bottom on the chart, the pair struggles with breaking back above 1.0630. The most recent attempt of breaking above has triggered a pullback and a bearish engulfing pattern surfaced on D1 interval. A move back towards recent lows in the 1.0370 area cannot be ruled out. However, a 1.05 area may provide some short-term support.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.