The EURUSD has plunged to 1.0428, marking a sharp 0.7% decline against a broadly strengthening U.S. dollar, as President Trump's aggressive stance on trade tariffs triggers a flight to safety. The greenback's surge gained momentum after Trump's announcement of plans for "much bigger" universal tariffs, dismissing the Treasury's proposed 2.5% rate as insufficient.

Dollar Dominance

The U.S. dollar has strengthened across the board, with the Dollar Index climbing 0.4% following Trump's latest comments. The broader market impact has been significant, with risk-sensitive currencies retreating and safe-haven flows benefiting the dollar. Market participants are rapidly adjusting positions, with hedge funds increasing their long-dollar exposure amid expectations that protectionist policies will continue to support the greenback.

Tariff Impact

The proposed escalating tariff structure, potentially reaching 20%, poses a particular threat to the eurozone's export-driven economy. European automakers and industrial manufacturers are especially vulnerable, with the potential tariffs on semiconductors and metals threatening to disrupt crucial supply chains. Market analysts estimate that a 20% universal tariff could reduce eurozone GDP growth by 0.3-0.5 percentage points in 2025.

European Economic Challenges

Adding to the euro's woes, the eurozone economy continues to show signs of weakness, particularly in its largest member state. Germany's flatlining Q4 GDP and disappointing IFO business expectations have reinforced concerns about the region's growth trajectory. The eurozone's significant trade surplus with the U.S. makes it particularly vulnerable to any escalation in trade tensions, creating additional headwinds for the common currency.

ECB Rate Cut Path

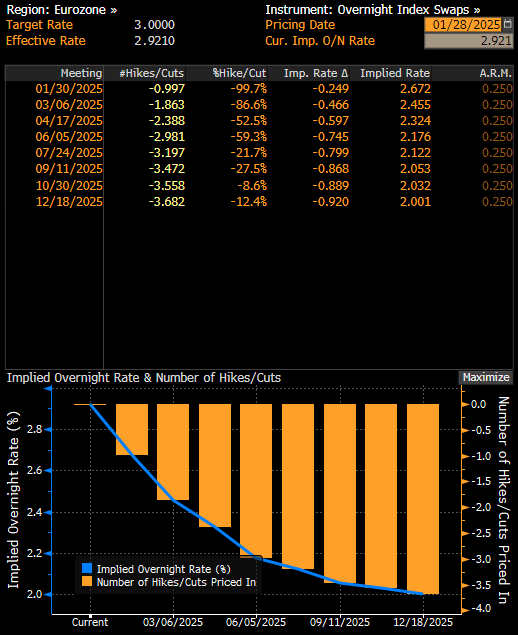

The European Central Bank finds itself in an increasingly complex position as it balances weak economic data against its inflation mandate. Market pricing now reflects expectations for more aggressive monetary easing, with three 25-basis-point cuts fully priced in for 2025. The ECB's President Christine Lagarde faces mounting pressure to address both growth concerns and the potential impact of U.S. trade measures at this week's meeting.

Implied rate cuts in Eurozone. Source: Bloomberg

Market Outlook

Near-term direction appears heavily skewed toward further euro weakness as dollar strength persists.The currency pair remains highly sensitive to U.S. trade policy headlines, with volatility expected to remain elevated as markets digest the implications of potential tariff increases of up to 20%. The traditional yield advantage that might normally support the euro has been overshadowed by these broader macro concerns and the dollar's renewed safe-haven appeal.

EURUSD (D1 Interval)

The EURUSD is approaching the 23.6% Fibonacci retracement level, which coincides with the 50-day SMA. This level is expected to act as strong support, having played a significant role in trading over the past two months. If a reversal occurs, the 38.2% Fibonacci retracement level, followed by the 100-day SMA, will become key resistance levels to watch.

The RSI is attempting to break an upward divergence, while the MACD is tightening and shows signs of potential bearish divergence, signaling caution for bulls. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.