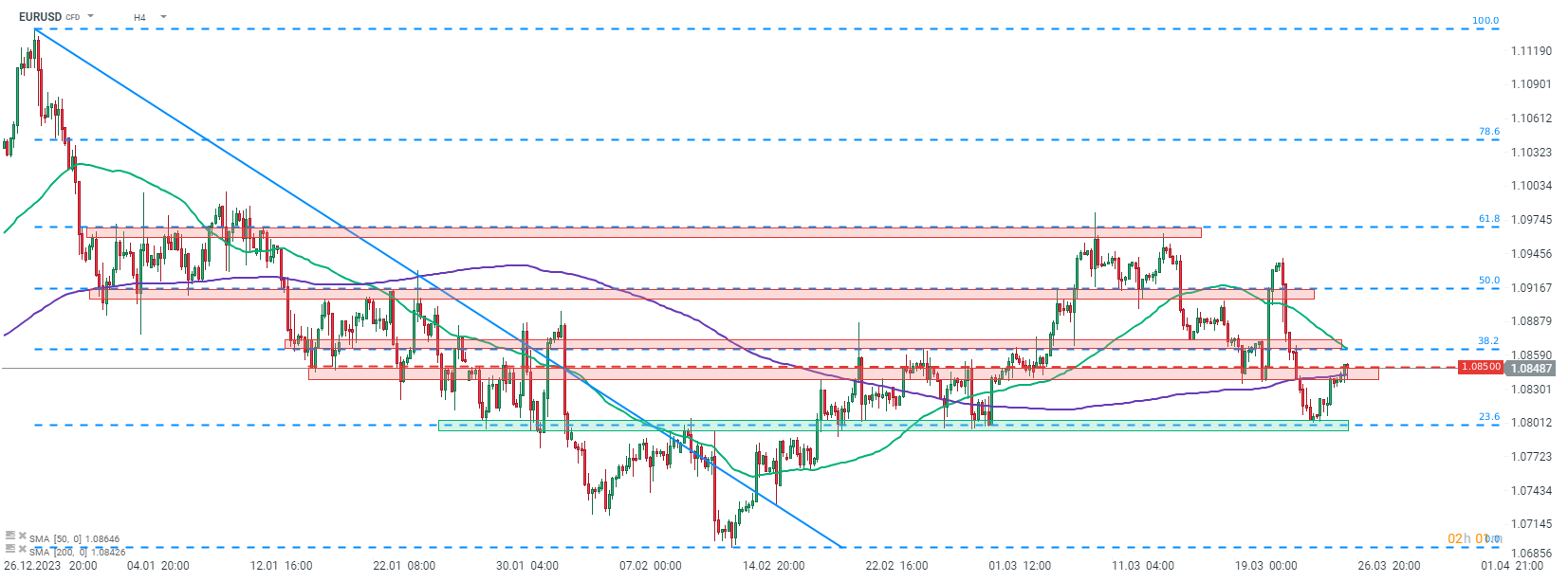

Last week was marked with USD strengthening, but this trend is being tested this week. Taking a look at EURUSD chart at H4 interval, we can see that the halted last week's pullback at the 1.0800 support zone, marked with 23.6% retracement of the downward move launched at the end of December 2023. A recovery move was launched this week with the pair climbing to the 1.0850 resistance zone today, marked with 200-period moving average (purple line) as well as previous price reactions. The next potential resistance to watch, in case of a break higher, can be found in the 1.0865 area, marked with 38.2% retracement and 50-period moving average (green line).

Spanish final GDP report for Q4 2023 was released this morning at 8:00 am GMT. However, as the report confirmed flash readings, there was no reaction on the market. Nevertheless, EURUSD may see some volatility in the afternoon today, when US durable goods orders report for February and Conference Board consumer confidence index for March are released at 12:30 pm GMT and 2:00 pm GMT, respectively. Also, EUR may see some more moves tomorrow in the morning when flash CPI release for February from Spain is released (8:00 am GMT).

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.