Release of the US CPI data for July at 1:30 pm BST is a key event of the day. Market expects headline measure to decelerate from 5.4% to 5.3% YoY. Core gauge is seen dropping from 4.5% to 4.3% YoY. However, one should remember that actual CPI data turned out to be higher than expected during the past three releases. Having said that, one cannot rule out an acceleration in the US price growth in July. Should it be a major acceleration, USD may catch a bid. The latest solid data from the US jobs market has boosted odds for a quicker Fed taper announcement and another acceleration in price growth may only cement such a view. In such a scenario, apart from the USD strengthening, gold should weaken.

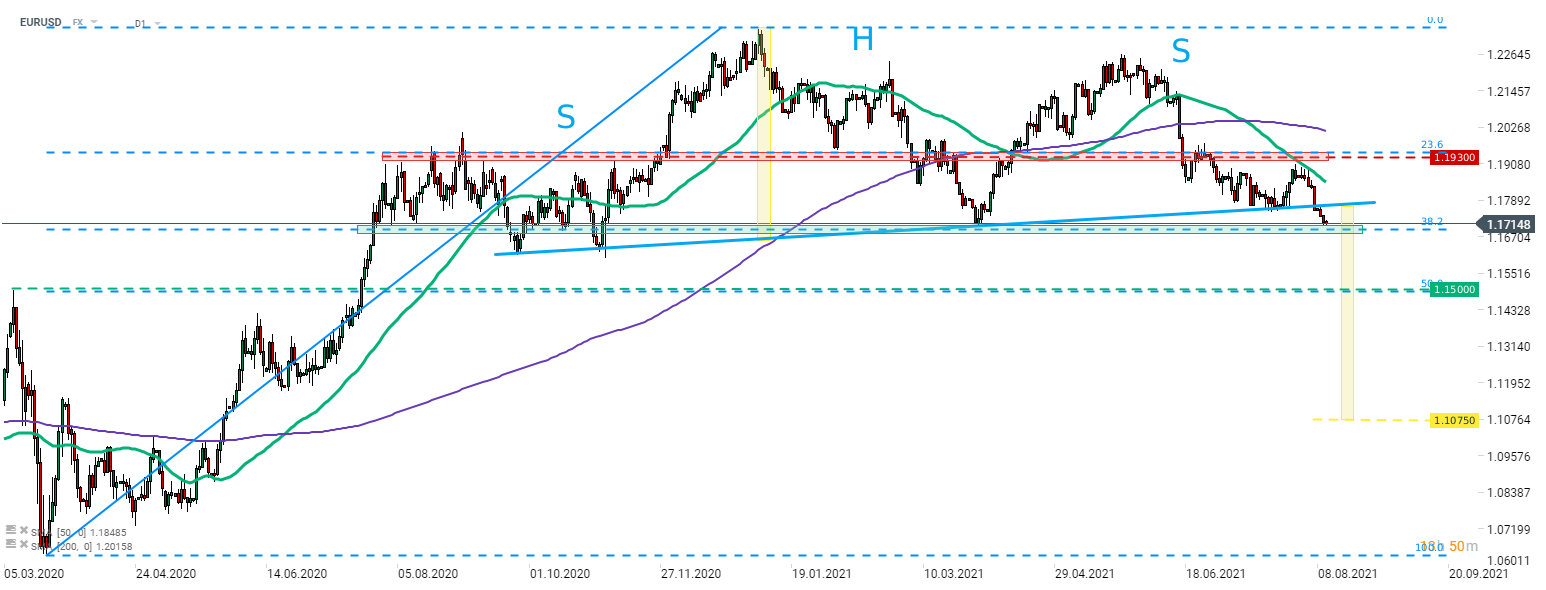

EURUSD has recently broken below the neckline of a large head and shoulders pattern. Potential range of the breakout from this pattern points to a drop below 1.1100. However, the pair needs to drop below the mid-term support area ranging around 38.2% retracement of the upward move launch in March 2020 (1.1700). Volatility on the pair is expected to jump around data release time (1:30 pm BST).

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.