The world's largest currency pair, the Eurodollar is trading almost 0.1% lower today. Investors learned about the composite and services PMI readings from the Eurozone. Attention now shifts to key publications from the United States, which are the ADP Report scheduled for 1:15 PM BST. and the ISM services, which will be learned around 3 PM BST. Data from Europe performed mixed, although expectations exceeded Germany in both the services and composite indexes. Global macro data are sending fairly mixed composite signals, but none of today's readings seem to speak particularly in favour of the euro. Rather, the question is whether the data from the United States will prove consistently weak enough to lead the bulls to regain the upper hand on the Eurodollar?

What if... Strong pressure in services will weaken the dollar?

- The Eurozone PPI publication indicated that European producer price disinflation in April accelerated to -5.7% y/y vs. -5.3% forecasts. What's more, PMIs (including services) for the entire Eurozone, which is patronized by the ECB, came in slightly below forecasts (53.2 vs. 53.3 expectations for the composite index and 52.2 vs. 52.3 forecasts in services).

- The overall picture of today's publications is thus mildly dovish, and tomorrow the Eurodollar currency market will get an 'opportunity' to reassess the strength of both economies, in the face of a decision by the ECB, which will almost certainly cut interest rates by 25 bps, while the Fed is likely to do so in early autumn at the earliest

- Meanwhile, investors are bracing for the ADP report from the US, which is expected to show a smaller-than-expected change in private labour market employment of 175,000 in May versus 192,000 in April. However, if the data turns out to be slightly better, it will in a way undermine yesterday's dovish JOLTS, which indicated the smallest number of job vacancies in the US since 2021. Moreover, the market is expecting an improvement in the services ISM, and it is on this data that the markets' attention may focus today.

- Price pressures in services are hard to combat (even more so with over 2% GDP growth and real wage growth), and additional underlying factors may begin to gradually lift the dynamics of US inflation readings. The market expects the May ISM to come in at 50.8 versus 49.4 in the April data, but attention will focus on the price sub-index, where investors expect a reading of 59 versus 59.2 previously.

A high price ISM prices paid index with a weaker ISM could paradoxically hurt the dollar, suggesting potential 'economic damage' from the prospect of continued hawkish direction at the Fed, despite apparent weakness in the economy. On the other hand, if the elevated price sub-index is also 'justified' by a strong reading of the composite services index, we can expect a strengthening of the dollar and further declines on the Eurodollar.

3 PM BST, ISM services report from the US. Expectations: 50.8 Previously: 49,4

- Business Activity. Expectations: 53 Previously: 50.9

- Prices paid. Expectations: 59 vs. 59.2 previously

- Employment. Expectations: 47.2 vs. 45.9 previously

- New orders: Expectations: 53.2 vs 52.2 previously

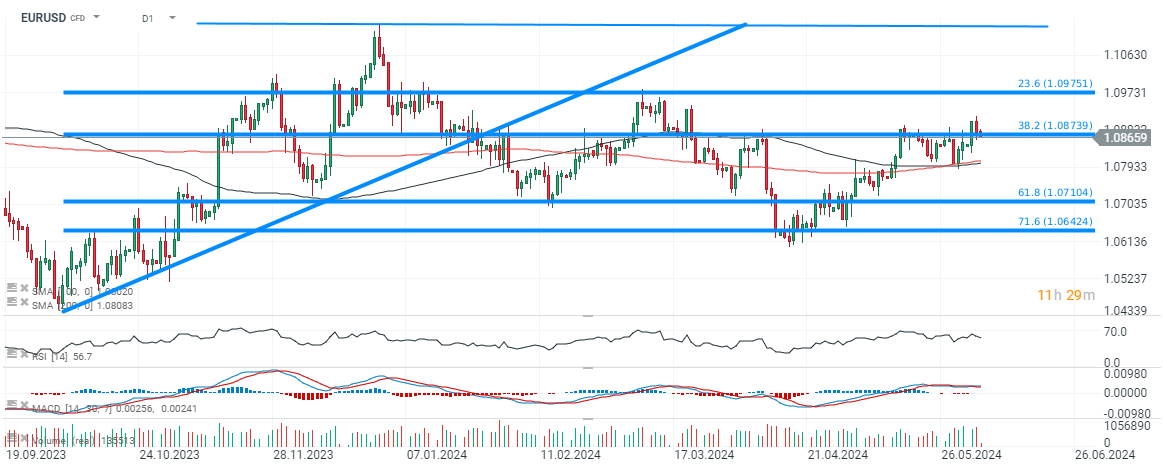

EURUSD chart (D1)

EURUSD today settled below the 38.2 Fibonacci retracement of the upward wave from the autumn of 2023, and the pair once again failed to stay above 1.09. In the event of a stronger sell-off, a test of the 1.08 area is not ruled out. On the other hand, the main psychological resistance for the trend is still located in the 1.097 - 1.10 zone, and the pair recently defended itself from falling below the SMA200 (red line).

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.