FOMC decision yesterday was a key event of the week and now attention shifts to the second most important release of the week - US GDP report for Q2 2022. However, while this is unquestionably the top reading of the day, it is not the only one that is noteworthy. German CPI inflation figures for July will be released today at 1:00 pm BST. ECB has taken note of an increase in inflation and has even decided to deliver the first rate hike in more than a decade. Continued pick-up in price growth may be a decisive factor when it comes to rate decisions in September. So far, data from German states have been mixed - year-over-year price growth accelerated in North Rhine Westphalia and Bavaria while slowing in Hesse and Brandenburg. Market expects headline German reading to show a drop from 7.6% to 7.4% YoY, what would be a welcome development.

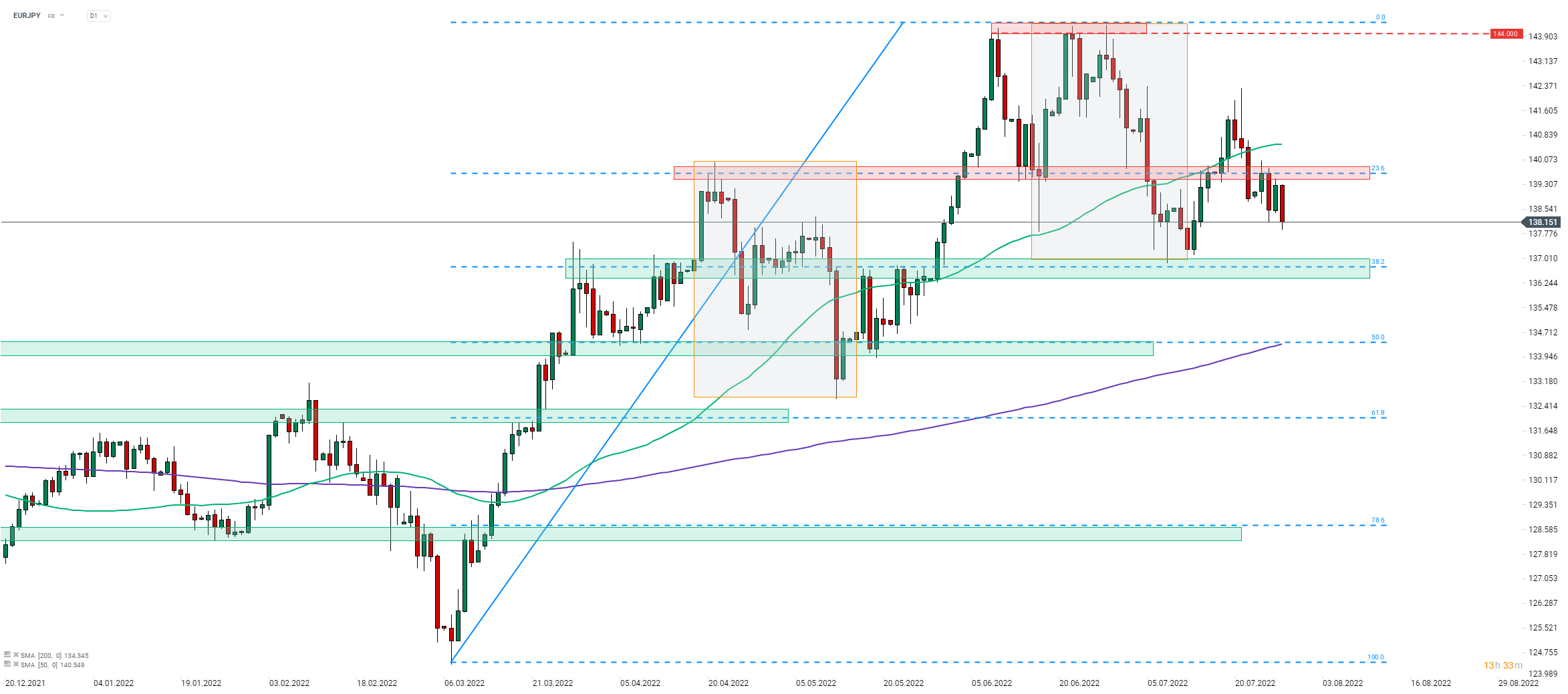

Taking a look at EURJPY chart at D1 interval, we can see that the pair has been underperforming recently. The most recent move lower was driven mostly by JPY strengthening rather than EUR weakening, with Japanese currency strengthening significantly amid more dovish Fed bets. A key near-term level to watch in case downward move deepens can be found at around 137.00, marked by the lower limit of the Overbalance structure.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile app Source: xStation5

Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.