EURJPY is one of the pairs that has seen some wild moves today and is expected to remain volatile, at least during the European morning session.

Pair spiked following the Bank of Japan monetary policy decision. BoJ decided to keep rates as well as yield curve control (YCC) mechanism unchanged during the first meeting under new governor Ueda. A line promising rates to be kept at current or lower levels was removed from the statement. While this could be seen as a somewhat hawkish move, the Bank of Japan also said that it will conduct a review of its monetary policy and that it will last 1-1.5 years. JPY slumped as investors took it as a suggestion that any shift in BoJ policy will not come until review is completed. Even assurances from Ueda at post-meeting conference that conducting review does not mean that policy will stay unchanged for those 1-1.5 years failed to change investors sentiment towards JPY. Speaking on YCC, Ueda said that it will remain in place until achieving the price target is in sight.

When it comes to EUR, a number of CPI and GDP reports from the Old Continent will be released today. French GDP data came in-line with expectations while French CPI unexpectedly accelerated. Spanish data showed better-than-expected Q1 GDP growth but also a larger-than-expected acceleration in CPI. German GDP data at 9:00 am BST and CPI data at 1:00 pm BST will also be on watch.

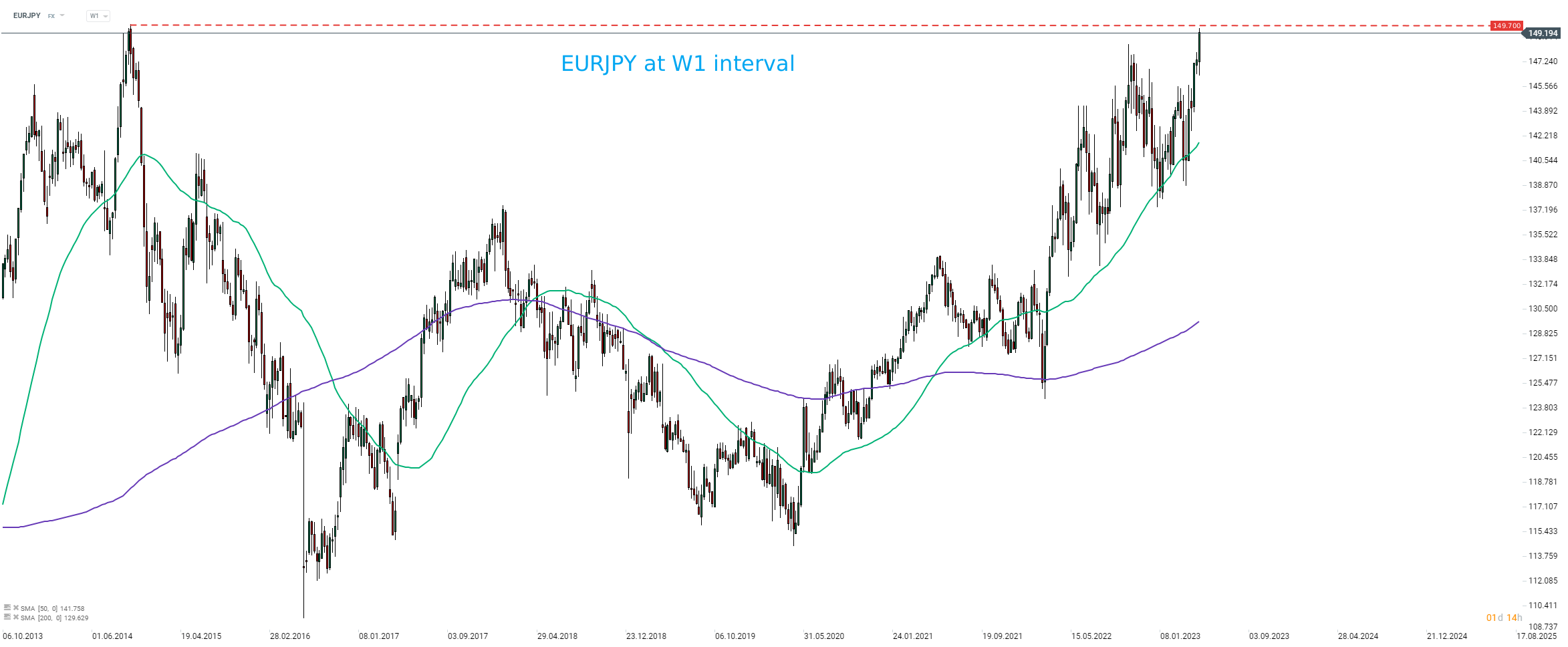

Taking a look at EURJPY at D1 interval, we can see that the pair has climbed above October 2022 high in the 148.40 area and is trading at the highest level since 2014. Moreover, 2014 highs are just a touch away at 149.70 and a break above would push the pair to levels not seen in 15 years!

EURJPY at D1 interval. Source: xStation5

EURJPY at D1 interval. Source: xStation5

EURJPY is slowly but steadily approaching 2014 highs in the 149.70 area. Source: xStation5

EURJPY is slowly but steadily approaching 2014 highs in the 149.70 area. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.