Minutes from the latest meeting of the European Central Bank's Governing Council are a highlight in today's economic calendar (12:30 pm BST). FOMC minutes released yesterday turned out to be a rather hawkish one with the US central bank signaling that it will not hesitate to tighten policy at an even faster rate if the situation requires it. Such a strong hawkish message is not expected from the European Central Bank. However, the document may provide some crucial insight. The ECB has announced at the latest meeting that rate hikes are coming but it is still uncertain how long the cycle will go and how high rates will increase. While clear answers to these questions are unlikely to be found in ECB minutes, some guidance may be provided.

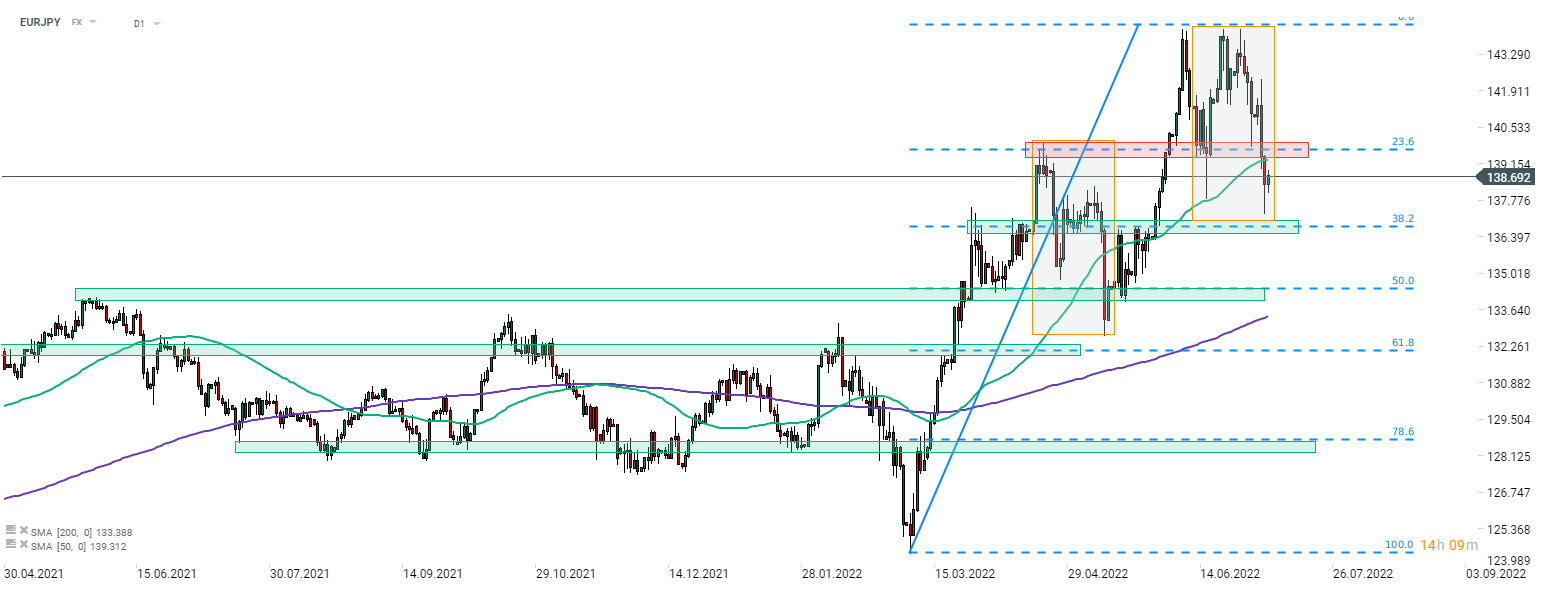

Taking a look at EURJPY chart at D1 interval, we can see that the common currency has lost some ground against the Japanese yen recently, even as JPY has been a rather weak performer recently. Nevertheless, uptrend seems to be still in play as the pair manages to stay above the lower limit of a market geometry in the 137.00 area, which is also marked with 38.2% retracement of the upward move started in March 2022. As long as the price stays above the 137.00 area, technical outlook continues to favor bulls.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.